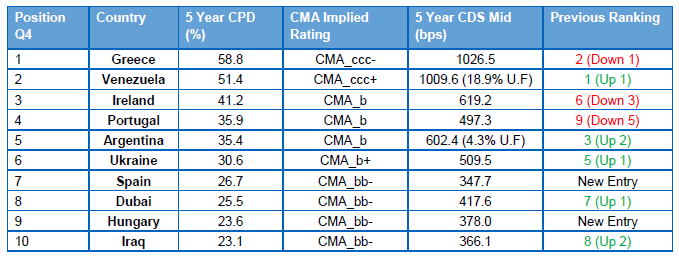

This is pretty useful info if you’re putting together global portfolios. Not all countries bear the same risks in this indebted global economy (via Alea):

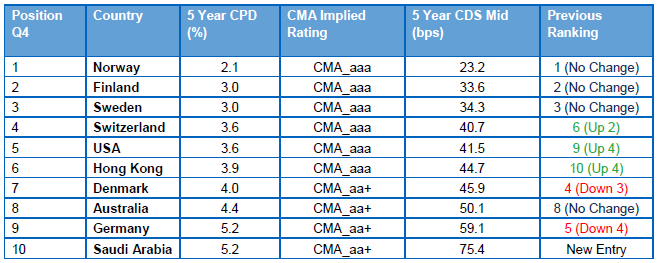

“This quarter there were few surprises in the list of the top ten most risky sovereigns, with Greece at the top of the table, followed by Venezuela, Ireland and Portugal, and there were no changes to the top eight least risky, although The Netherlands dropped out of the top ten.

However, the top five worst performers for the quarter are from Western Europe, confirmation that 2010 was one of the most difficult years for the region since the introduction of the euro in 1999. The report found that UK CDS widened 13% in the quarter following the bail out of Ireland.”

The most risky

The least risky

The least risky

Source: CMA

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.