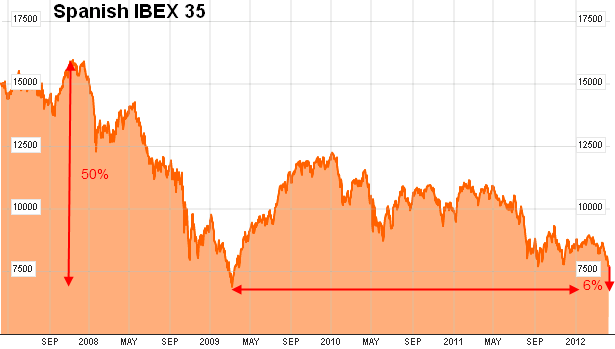

Here’s a really incredible chart. Do you follow the Spanish stock market? Yes, me neither. So I was surprised to notice this incredible chart of the pain in Spanish equities. Despite recovering briefly in 2009 they’ve been on a perpetual downward spiral ever since. The IBEX 35 now sits just 6% above the March 2009 panic low and a staggering 50% below the 2007 highs. Incredible.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.