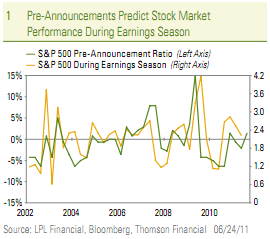

LPL Financial provided some good commentary on the recent negative trend in pre-announcements. Pre-announcements occur during the period before earnings season officially begins. Thus far, they are running a bit higher than usual:

“So far, the ratio of negative-to-positive pre-announcements is 2.3, above the historical average pre-announcement ratio of 2.1. An above-average ratio has often lowered the bar on expectations heading into the earnings season as market participants price in a greater probability of company’s missing analysts’ estimates. Over the past 10 years, an above average ratio of 2.3 has been followed by a gain of about 2% in the S&P 500 during the earnings season.

While the above average pre-announcement ratio may be a small positive for the earnings season once it gets underway, the next few weeks may continue to feature negative pre-announcements and modest losses for the stock market. Although the track record indicates a modest gain for stocks during the earnings season, there is a risk that stocks will buck the trend and continue to decline during the earnings season despite the above-average negative pre-announcements.”

This is a market environment that continues to confound investors though. Despite a seemingly weak domestic economy corporate profits continue to boom. Well, the story might be easier to understand than most presume. Massive cost cuts and a lack of hiring has resulted in wide margins. Domestic growth has been tepid, but strong enough to sustain low domestic revenue growth. More importantly, international growth (primarily Asia) has been quite strong. All of this leads to relatively good revenue growth, fat margins and surging bottom line growth. Although we’ve seen some signs of softening in recent macro data we haven’t seen any indications that Asia is really falling off the map. In my opinion, this remains the linchpin in the corporate profit story. So, low unit labor costs and strong Asian growth = good bottom line growth. Pre-announcement risk might be elevated, but it’s nothing to panic over. If we begin to see signs of real slowing in China then the profit picture will take a significant turn south. We’re not there yet.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.