When I started this website I knew pretty quickly what would generate traffic and attention. If you write about things that really scare people, conspiracy theories, Apple and gold you can drive enough traffic to a financial website to make a decent living (until people realize you’re basically scamming them). I told myself I’d choose quality over quantity and that I would TRY, above all else, to provide relevant, educational and ACCURATE information for people. I knew it wouldn’t be enough to make the site sustain itself, but I truly felt that the alternative was a dishonest and low value way to write about finance, money and investing. I don’t always succeed in this goal, but I always try.

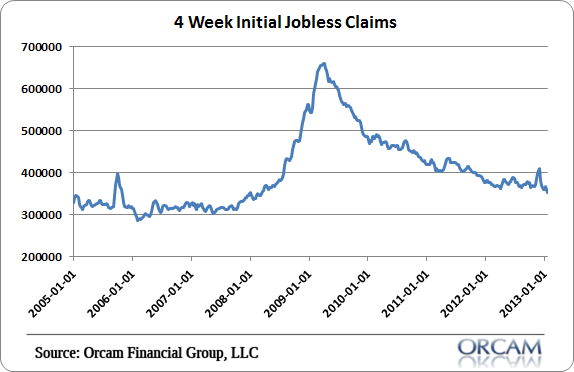

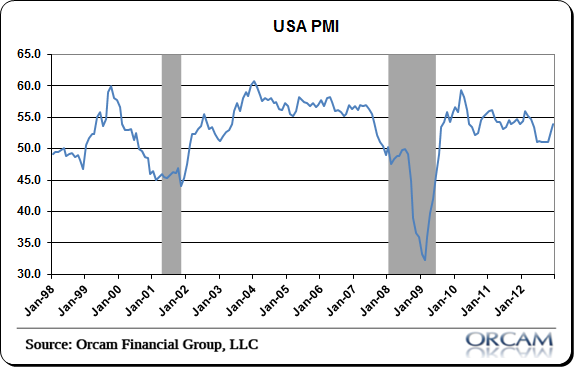

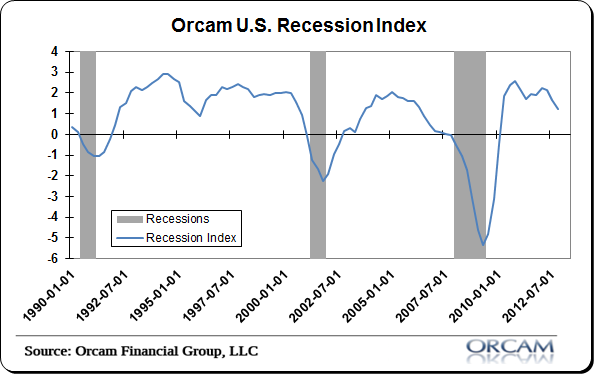

One of the few things I’ve been right about is the “no recession” call since many notable investors and pundits began loudly declaring recession in late 2011. I said none of the indicators were pointing to renewed recession and that the likelihood was for continued meager growth within the de-leveraging cycle. In essence, misunderstanding the balance sheet recession was deadly for your portfolio and your general understanding of macro trends.

Now, I know I don’t make many friends writing happy things about the economy, but the bottom line is that the global economy could be much worse, policy makers could be wrecking the economy and American businesses could be far worse off than they are. We’re in this world where things are adequate enough to remain positive. All things considered, that’s pretty positive since we’re coming out of the worst and most unusual economic crisis of the last 80 years. This morning’s economic data was just further confirmation of this reality. Here are three clear indications that the recession calls were completely wrong and are likely to remain wrong for the foreseeable future.

1. Jobless claims are at a post-recession low:

2. US PMI continues to show a clear expansionary trend:

3. The Orcam Recession Index, which helps steer me to my main conclusion regarding growth, remains positive:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.