Here’s an excerpt from a recent research piece published at Orcam (read the full piece here). Obviously, with my macro focus and an entirely new company designed around this macro focus, I’ve made a big bet on the future. And I think there are few things changing the landscape of investing more than the trend towards global macro investing.

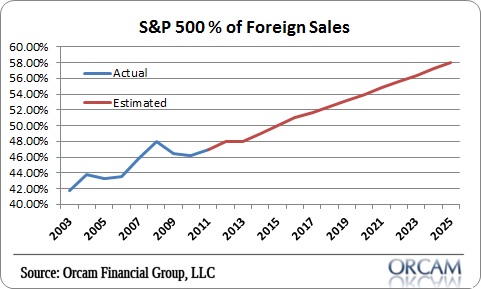

Among the big trends I see coming is the diversification of corporations across the globe. As developed economies mature and emerging economies demand superior living standards there is a massive convergence occurring that is becoming increasingly expedited by technology and globalization. This is diversifying corporations, broadening customer bases and bringing supply and demand together in a way that has never before been scalable. This can best be seen in the growth in S&P 500 revenues where the trend is quickly changing towards a global S&P 500. I presume the day will come when the vast majority of S&P 500 profits will no longer come from within the USA. In fact, if we become a truly global economy then one day we should expect the overwhelming majority of S&P 500 revenues to come from abroad:

“S&P 500 corporations are no longer just US companies. They are increasingly global corporations. This is

a trend that is becoming more and more pervasive. 2015 is likely to be the first year where most of the S&P 500’s revenues were generated from foreign countries. As emerging markets become increasingly developed and developed economies continue to mature we’re likely to see this convergence continue.The USA, for instance, currently represents 23% of global GDP, but US corporations are generating 46% of their revenues from abroad. It’s not unreasonable to assume that the natural trend for S&P 500 revenues

is towards something in the 70-80% range as the developed economies mature and corportiaons reach out to higher growth revenue sources. There is a huge growth opportunity that domestic corporations

are still only partially taking advantage of. This means US markets are becoming international markets. In other words, US assets are becoming international assets.”

(Source: Orcam Financial Group)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.