I’ve spent a fair amount of time over the years discussing the conservative myths about government debt, the bond bubble myth, the coming insolvency of the USA, the inevitable US hyperinflation, etc. In my opinion, these ideas were based on a flawed ideology driven largely by a political agenda as opposed to sound analysis of the monetary system.

As I read through various articles today I see an equally misguided and ideological rage from the liberal side. For instance, this piece by Matthew Yglesias discusses how he’s veering increasingly towards a Marxist view of the world because he sees the current system as failing. And then there’s this piece by Henry Blodget discussing how we’ve all been “shafted” by the system. The rhetoric is the sort of politically charged stuff you expect to read on Mises.org. Not that there’s anything wrong with that, but it’s usually pretty easy to pinpoint a politically motivated argument when the rhetoric is so extremist. In my opinion, that sort of commentary takes away from the argument.

The general gist of these liberal arguments (which are becoming increasingly prominent) is to imply that the American capitalist system has somehow failed us miserably and that the only way we can be rescued from the capitalists is to have the government come in on its white horse. There’s probably some of truth to that. I’m not an anti-government type, but I do think there should be balance in these discussions. And historically, the private sector driven economy with a government acting as a facilitator, tends to do us all well over time. Recent history is an unusual case of economic extremes, but I don’t think it should lead us to believe that the system needs to be scrapped or overhauled. Could we do a lot of things better? You bet. But let’s also remember that things are not nearly as bad as you think. Let’s take a macro perspective of some of the facts. Here are some eye popping facts from globalrichlist.com:

1) The median household income in the USA is roughly $50,500. Did you know that that is the top 0.27% of world incomes? That’s right. The average American is the global 1%. You think you have it bad? Most of us in the USA have no idea what “bad” even is.

2) The average wage in the USA is $26.30 per hour – Meanwhile, the average labourer in Indonesia makes just $0.39 in the same time.

3) The median household income is $50,500 per year in the USA. It would take the average labourer in Indonesia 68 years to earn the same amount.

4) It takes you 2 minutes to earn enough for a can of soda. It takes the average laborer in Indonesia around 2 hours for it.

5) Your monthly income could pay the monthly salaries of 226 doctors in Pakistan.

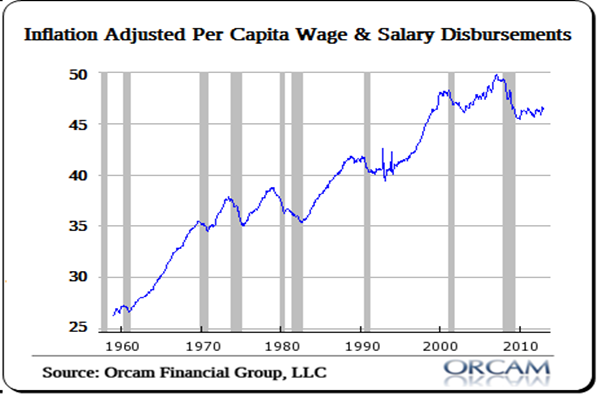

The right scares us with too much government and the left scares us with not enough government and the failure of capitalists. But the reality is that life in the USA isn’t nearly as bad as most would have you believe. Yes, even during the reign of terror of the capitalists since the 1970s we’ve seen our living standards explode. Most liberals love to cherry pick wage data in the same way that conservatives cherry pick government debt data. They don’t put it in the proper perspective. When we actually take the wages in the USA and adjust them for inflation on a per capita basis the picture begins to look pretty different:

You can see the troubles of the last 10 years which is likely where much of the anger comes from. But when we take a step back the picture doesn’t look so bad. Our living standards, on a purely financial basis, have almost doubled on a per capita basis since 1960. We work a lot less for the same amount of goods and services that we could buy in 1960. Not bad.

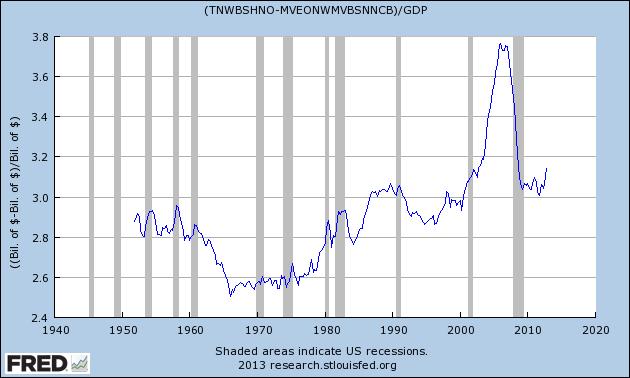

You can also see a similar story in the household net worth picture. Even with a housing collapse and a total subtraction of equity market values (because liberals will inevitably say that the stock market is only owned by the wealthy) you can see that net worth has held up pretty consistently relative to GDP over the years. That’s a very different picture than the one Yglesias shows us where it looks like our living standards have cratered into some hole.

Anyhow, I’m not here to say the American capitalist system is perfect or that it’s got no flaws and no hardships attached to it. I am plenty critical of many facets of the current malaise, government policy and private sector malfeasance. But I think it’s nice to maintain some perspective of how much of a “failure” the American system really is.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.