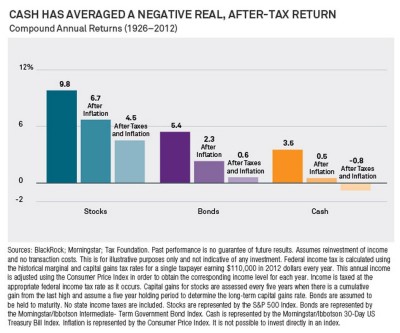

Great chart here from Josh Brown today showing the real after-tax return from cash relative to other asset classes (see figure 1). It stresses how important it is to understand the role of cash in a portfolio and how damaging it can be to hold excessive cash levels at all times.

One of the things I am trying to achieve with Orcam’s Portfolio Reviews is to communicate the concept of a “savings portfolio”. That is, most of us are not true “investors” in a secondary market (like a stock market) in the same sense that a private equity firm is when they actually front the money to help an operation grow. Most of us are just exchanging shares of stocks or bonds on a secondary market and the corporation actually has no involvement in any of this. So we’re not actually investing in Apple when we buy shares of AAPL on the exchange. We’re literally exchanging cash for stock with another PERSON and not the company. In other words, you’re simply allocating your savings.

Why does that matter? Well, “investing” is often synonymous with high returns and high risks. True investors like private equity firms who invest with start-ups and actually seed capital are generally engaging in a form of asset allocation that is substantially more risky than what we do when we buy shares of GE on the stock exchanges. Most of us spend our lives making real investments in ourselves. We spend huge amounts of time and resources becoming educated and working on perfecting a craft. And what we save from our primary source of income should be allocated in a highly prudent manner. This doesn’t mean we should never “invest”. It just means we have to stop looking at our portfolios as though they’re a fragment of our lives and begin to think of the broader role that a savings portfolio plays in our lives.

And when you recognize that your repository of income is literally your savings portfolio we realize that most of us shouldn’t be piling 100% of our savings into some fancy sounding strategy or assuming that we’re “diversified” by owning stocks alone. No, we should take a more all-encompassing view of our overall life portfolio and understand that our portfolios are a repository for our savings that need to grow, but also be protected.

The real goal for your life portfolio is to maximize the return from your real investments (like your primary form of work) and take the savings repository and allocate it in a manner that helps you protect against two primary risks:

1) The risk of purchasing power loss.

2) The risk of permanent loss.

You should construct portfolios that generate a moderately high risk adjusted return that protects you from these two risks. You don’t need to “beat the market”. In fact, it’s inappropriate for almost all of us to own 100% equity portfolios unless you’re willing to expose your savings to that rollercoaster ride. We’re not competing with the S&P 500. We’re competing against inflation and the risk of permanent loss. Personally, I’d rather grind it out at work all day and know that the savings I generate from that primary income source is not creating even more stress and uncertainty in my life. That’s the essence of the savings portfolio concept.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.