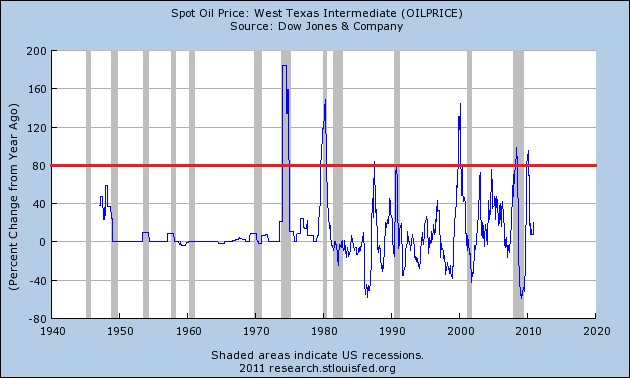

I recently listed rising oil prices as one of the primary risks to the economy in 2011. As we saw in the 70’s and in 2008 skyrocketing oil prices have the potential to wreak havoc on the US economy. In fact, over the last 40 years substantial year over year rises in oil prices have tended to precede recessions. With the exception of 1986 and 2010 80%+ year over year changes in oil have always been followed by recession:

In an article in yesterday’s FT Fatih Birol, the IEA’s chief economist said the surging price of oil now poses a very serious threat of causing a replay of 2008:

“Oil prices are entering a dangerous zone for the global economy. The oil import bills are becoming a threat to the economic recovery. This is a wake-up call to the oil consuming countries and to the oil producers….Oil exporters need clients with healthy economies but these high prices will sooner or later make the economies sick, which would mean the need for importing oil will be less…It is a very telling story. 2010 rang the first alarm bells and 2011 price levels could bring us to the same financial crisis times that we saw in 2008″

According to the FT the ratio of import bills to GDP is now approaching 2008 levels:

“The ratio of countries’ oil import bills to GDP, a key measure of the cost of oil prices on economies, is close to levels last seen during the financial crisis in 2008, Mr Birol warned.If oil prices remain above $90/barrel for the rest of this year then the ratio for the European Union will be 2.1 per cent – close to the 2.2 per cent level it reached in 2008.”

What’s worrisome today is that oil prices are surging during a normally weak seasonal period. The seasonally strong period during the late winter into the summer driving season tends to be when oil prices surge and top out. There is a very real threat that oil prices will continue to melt-up into the middle of the summer. In addition this happens to be when QE2 ends so it gives speculators all the more reason to hoard the commodity. Richard Fisher’s darkest moment could be on the verge of becoming a nightmare.

From the current levels of $90 every $15 rise in the price of oil will result in a 1% decrease in US GDP. The Wall Street Journal elaborated on the dramatic impact of rising oil prices:

“Gas prices are already at about $3 per gallon and winter is usually the weakest time for gas prices. The recent surge in crude oil has raised the possibility that gasoline could hit $4 by the peak summer driving season. The big danger is that saber-rattling in the Middle East or an unexpected refinery shutdown could push prices closer to a sawbuck a gallon. Given that Americans use about 378 million gallons of gas per day, each dollar rise in gas prices, if sustained, means $2.6 billion a week must be diverted toward the gas pump and away from other spending.”

As David Rosenberg noted in yesterday’s strategy note this will more than erase the recently passed tax cut:

“Oil prices have broken above $90/bbl and we seem to recall that when this happened in 2007, an unexpected recession followed four months later. Yesterday’s USA Today ran with an article quoting some energy experts predicting that gasoline prices, already north of $3 a gallon, may yet test $4 a gallon before long. Now that would pretty well take care of that payroll tax cut … and then some. Looking at the near record net speculative long positions on the New York Mercantile Exchange as far as light sweet crude is concerned, it is abundantly clear that this runup in oil prices is not merely related to physical demand. Remember that it was this investment-related action in 2008 that ultimately caused the price to head into reverse as the physical demand growth went into reverse (as an aside, speculative longs in copper have also reached five year highs).”

Although I’ve maintained for several years now that the threat of inflation (and especially hyperinflation) is overstated the threat of cost push inflation via oil prices remains a very real threat to the US economy. Although it’s highly unlikely that high prices can be sustained (consumers remain far too weak) and seen in broader end inflation data there is the threat that oil prices rally in 2011 and put even greater pressure on a weak economy as debt laden consumers are forced to reallocate spending. High oil prices exposed the US economy as a deflationary trap in 2008. As Fatih Birol said there is a very real threat that high oil prices once again expose an economy suffering from massive deflationary pressures. There are, arguably, few things more important to the continued prosperity of the US economy than alleviating this foreign energy dependence.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.