The Russian financial crisis and eventual default is often cited as a counterargument to one of the principle MR ideas that a sovereign currency issuer should not be able to go bankrupt. It’s a complex subject that is worth spending some time on.

Russia was a rather unique situation. Most people who study the Russian default are fixated on the fact that Russia defaulted on their debt. They focus almost entirely on the ultimate cause of death without actually studying what led to the default. This is similar to studying a man who dies of a heart attack and concluding that his bad heart was what was wrong with him. And while that might be true, a more thorough examination is likely to show you that a series of things (diet, smoking, lack of exercise, etc) actually led to broad problems that ultimately culminated in a heart attack. This lack of analysis leads many observers to conclude that Russia had too much debt, defaulted, end of story. This sort of simple analysis leads to simple conclusions which leads to misconceptions. The truth, as is generally the case, is more complex.

When one looks at the history of Russia you actually find many similarities with my conclusions in “Hyperinflation – It’s More Than Just a Monetary Phenomenon“. In the case of Russia, we actually have many of the same elements leading to hyperinflation and then default. In this particular case, we have loss of a war, regime change, collapse of the tax system, political corruption, foreign denominated debts and collapse of productivity. In other words, from an MR perspective, this country was ripe for self destruction as they met almost all of the criteria that precede a hyperinflation and/or crisis resulting from ceding of monetary sovereignty.

I don’t have nearly the time or the space to cover the sequence of events in its entirety, but it’s important to understand that Russia’s eventual hyperinflation and 1998 default is actually rooted in the break-up of the USSR which occurred in 1991. The dissolution of the USSR was the largest dissolution of any socialist state and resulted in 15 sovereign states. Russia was the surviving state formerly known as the USSR and the burden that accompanied this was extraordinary. As you can imagine, the collapse of one of the worlds super powers was highly traumatic as the government and its people attempted to transition. Here we have the first two common elements in hyperinflations – loss of a war & regime change. The third crucial element was foreign denominated debts from their Soviet predecessors. How problematic was this? Pravda explains how Russia only just managed to pay off this heavy burden a few years ago:

“The Soviet Union left a huge debt after its collapse. Russia became the only country to inherit not only the foreign property of the former USSR, but all of its foreign debts as well. It was extremely hard for Russia to serve the debt because the economy was declining steadily in the beginning of the 1990s. The Soviet debt had been restructured four times before the default of 1998. By 1999 Russia managed to either write off or delay the payments to private creditors (the London Club, for instance). However, such a compromise proved to be impossible with the Paris Club of Creditors.”

From an MR perspective, the story essentially concludes itself right there. This country was never truly sovereign because it was essentially a currency user when the new regime was established and Russia was saddled with the foreign denominated debts of the old USSR. In other words, ceding your monetary sovereignty proved disastrous as we’re now seeing in Europe. But there’s actually more to it than just that. Their errors multiplied as the years went on.

Many analysts and critics of the Russian default like to imply that Russia was simply spending uncontrollably and that their default is an excess of spending and government largess. But that’s not exactly accurate. Turmoil in the regime change and political disunity made tax collections increasingly difficult as the new regime took control. The St Louis Fed cites corruption and the drop in tax collections as the primary cause of the ballooning deficit:

“Another weakness in the Russian economy was low tax collection, which caused the public sector deficit to remain high. The majority of tax revenues came from taxes that were shared between the regional and federal governments, which fostered competition among the different levels of government over the distribution. According to Shleifer and Treisman (2000), this kind of tax sharing can result in conflicting incentives for regional governments and lead them to help firms conceal part of their taxable profit from the federal government in order to reduce the firms’ total tax payments. In return, the firm would then make transfers to the accommodating regional government.”

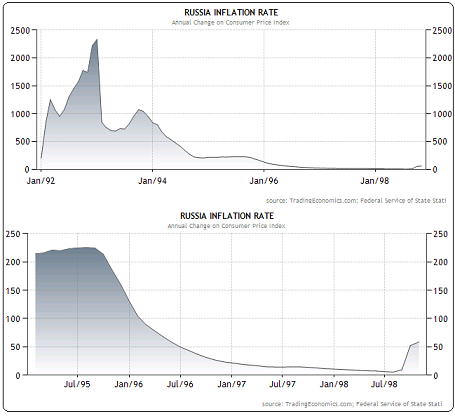

The country would eventually go to the IMF in 1996 seeking aid. This further relinquished their sovereignty. All the while, inflation was ravaging the country leading to unrest and increased economic turmoil. Their rolling hyperinflation leftover from the trauma of the collapse of the USSR never really ended. Even into the late 90’s the country suffered from high double digit inflation:

The lack of economic diversity (their economy was highly dependent on oil exports) and foreign denominated debts made it vital that they grow via their trade surplus. In attempting to achieve this the country further ceded sovereignty by implementing a peg to the US Dollar. Further, in 1998 the Russian government cited the tax issue as a serious risk to the regime. They attempted a complete overhaul of the tax system, but the damage had already been done. As the Asian Crisis erupted in the late 90’s the fragility of the Russian economy was exposed. The government attempted to protect the Ruble during the crisis leading to massive hemorrhaging of FX reserves. In a 1998 paper Warren Mosler explained the impact of this policy:

“The marginal holder of ANY ruble bank deposit, at any Russian bank, had a choice of three options before the close of business each day.

(I will assume all rubles are in the banking system. Actual cash is unnecessary for the point I am making in this example.)

The three choices are:

Hold rubles in a clearing account at the Central Bank

Exchange ruble clearing balances for something else at the CB.

Buy a Russian GKO (tsy sec), which is an interest bearing account at the CB

b. Exchange rubles for $ at the official rate at the CB

For all practical purposes, 2a and 2b competed with each other. Russia had to offer high enough rates on its GKOs to compete with option 2b. In that sense interest rates were endogenous. Any attempt by the Russian Central Bank to lower rates, such as open market operations, would result in an outflow of $US reserves. The conditions for a stable ruble could not coexist. The net desire to save rubles was probably negative, the failure to enforce tax liabilities resulted in deficit spending even as the government tried to reduce spending, and the higher interest rate on GKO’s increased government spending even more.

At the time GKO rates were around 150% annually, and the interest payments themselves constituted at least the entire ruble budget deficit. It seemed to me that higher rates of interest were the driving factor behind the excess ruble spending which led to the loss of $US reserves.

With the $ in high demand due to a variety of factors, such as domestic taxed advantaged $US savings plans, insurance reserves, pension funds, and the like, and, exacerbating the situation, what could be called overly tight US fiscal policy, there was, for all practical purposes, no GKO interest rate that could stem the outflow of $US reserves.

The main source of $ reserves was, of course, $ loans from both the international private sector and international agencies such as the IMF. The ruble was overvalued as evidenced by the fact that $ reserves went out nearly as fast as they became available. The Russian Treasury responded by offering higher and higher rates on its GKO securities to compete with option 2b, without success. This inability to compete with option 2b is what finally leads to devaluation under a fixed exchange rate regime.”

But that wasn’t all. The global economy began to decline sharply as the Asian Financial Crisis unfolded in 1998. Russia was particularly hard hit as the oil and non-ferrous metals markets collapsed. The shock was enough to drive investors to believe that the Ruble would be massively devalued or debts would be defaulted on. In other words, Russia was built on a poor foundation and then driven into the ground as a series of events battered their economy and government.

In sum, you had a nearly perfect environment for a major economic calamity. And like my study of past hyperinflations, we find that the Russian default was actually much more than just a monetary phenomenon. In fact, it was rooted in much more devastating and complex issues than merely running high sovereign debts. The primary causes include regime change, loss of a war, foreign denominated debt and loss of monetary sovereignty via a pegged currency.

N.B. – It should go without saying that this situation is not even remotely analogous to the current situation in the USA.

Addendum – A brief note on willingness to pay via Warren Mosler:

“An extreme example is Russia in August 1998. The ruble was convertible into $US at the Russian Central Bank at the rate of 6.45 rubles per $US. The Russian government, desirous of maintaining this fixed exchange rate policy, was limited in its WILLINGNESS to pay by its holdings of $US reserves, since even at very high interest rates holders of rubles desired to exchange them for $US at the Russian Central Bank. Facing declining $US reserves, and unable to obtain additional reserves in international markets, convertibility was suspended around mid August, and the Russian Central Bank has no choice but to allow the ruble to float.

All throughout this process, the Russian Government had the ABILITY to pay in rubles. However, due to its choice of fixing the exchange rate at level above ‘market levels’ it was not, in mid August, WILLING to make payments in rubles. In fact, even after floating the ruble, when payment could have been made without losing reserves, the Russian Government, which included the Treasury and Central Bank, continued to be UNWILLING to make payments in rubles when due, both domestically and internationally. It defaulted on ruble payment BY CHOICE, as it always possessed the ABILITY to pay simply by crediting the appropriate accounts with rubles at the Central Bank.

Why Russia made this choice is the subject of much debate. However, there is no debate over the fact that Russia had the ABILITY to meet its notional ruble obligations but was UNWILLING to pay and instead CHOSE to default. “

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.