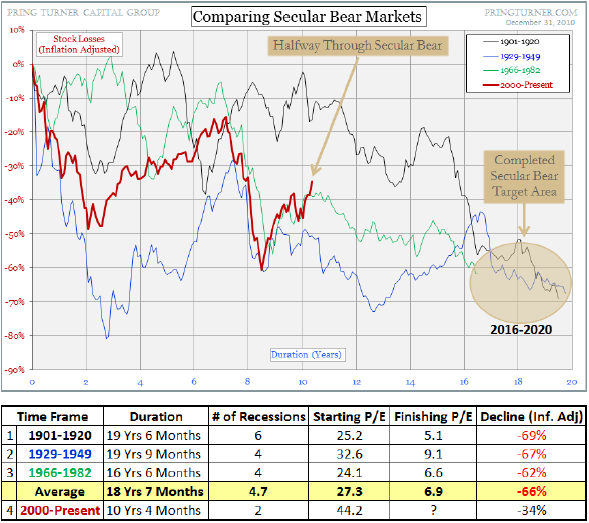

Pring Turner Capital has an updated version of their secular bear market comparison. According to them this bear is years from being over:

“Updating our duration and valuation benchmarks, again we find progress but not yet achieving the truly undervalued levels we expect to see toward the end of a secular bear market. Based upon previous cycles, it appears we are only slightly past the half way mark in terms of years, number of recessions, and valuations. A look at our chart and table comparing this to earlier secular bear markets illustrates our conclusion. We expect a major bottom for inflation adjusted stock prices is still years away before stocks finally gravitate toward the target area outlined below.”

Source: Pring Turner

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.