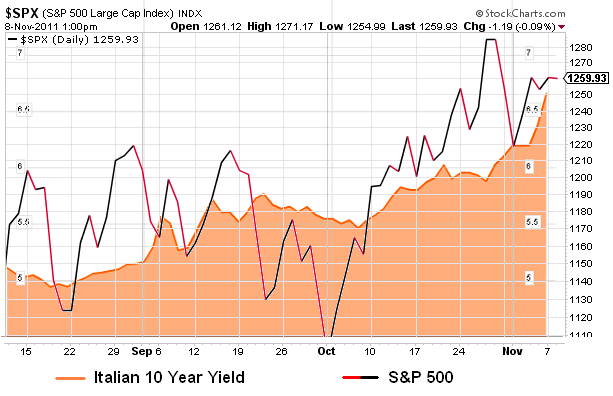

Here’s a chart that might surprise you. Over the last three months there is a pretty tight relationship between Italian bond yields and the S&P 500. Now, Italian yields should be the ultimate harbinger of doom in the EMU, but equity markets aren’t too phased by this. What gives?

There’s 1 of 2 things going on here in my opinion; 1) The equity market is over the Euro crisis and is certain that the EMU governments will fix this disaster. Or 2) There is now a disconnect between reality and perception. Which one is it? Perhaps a bit of both? I think the markets have now become comfortable with the idea that the EMU leadership is going to do everything in their power to avoid the worst case scenario. The worst case scenario is the one that ex-Europe needs to be most concerned about as the contagion from a banking crisis could be disastrous. If this risk has really been taken off the table then markets are right not to panic every time news breaks out of Europe.

So, if we remove the worst case scenario and focus on reality we can likely conclude that Europe will remain entangled in a nasty economic environment. If austerity is the continued strategy of choice (which appears clear) then the obvious question is – are the markets pricing in the possibility of prolonged and perhaps deep economic weakness in Europe? That part is less clear. Either way, markets appear almost uncomfortably comfortable with this uncertain environment….One which is almost certain to end badly whether it all blows up on them or just devolves into a lost decade as they dig through the wreckage that is an inherently flawed monetary union…..

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.