Peter Boockvar posted some ugly figures at Barry’s site yesterday. He notes the depressing math behind the Italian sovereign debt situation:

“REVISED: Here’s a back of the envelope calculation on Italy, highlighting the impact that a rise in financing costs coupled with a lack of growth can have on their finances. Italy needs to refinance about 310b euros of debt in 2012. I estimate the average interest rate they are paying on this maturing debt is 2.7% (short term rates collapsed in ’09-’10). With an average debt maturity of 7 years, Italy may be paying 6%+ on the refinancing. Assuming a 350 bps additional cost times the 310b euros of maturing debt, this adds 10.9b euros of interest expense to the 54b euros of interest payments scheduled to be made in 2012. At the same time, Italy’s 2T economy is expected to grow REAL GDP.1% in 2012 and nominal around 3%. Thus, nominally 60b euros will be added to their economy with all of the incremental gain thus going to service interest expense. This also doesn’t take into account any new debt Italy has to take on over and above what is maturing. Over time, just to tread water, any country needs to generate nominal GDP growth equal to its financing costs. In the 10 years prior to the sharp ’08-’09 economic contraction, Italy saw nominal GDP growth of 3.7% (REAL averaged 1.3%), near its financing costs over that time period. A continuation of nominal GDP growth of 3.5-4% (now mostly consisting of inflation) will no longer cut it for Italy with funding costs at current levels.”

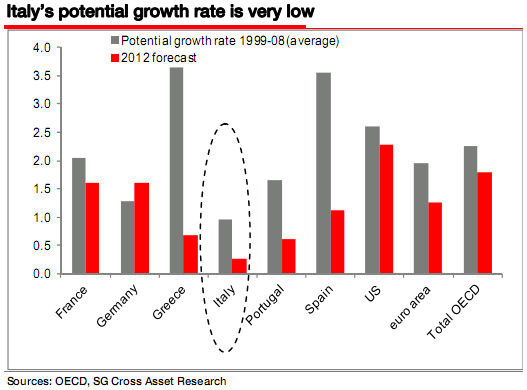

As we know with Greece, growth is the key. If these nations cannot grow their way out of this crisis then they are doomed to deteriorating budgets. The worst part about the situation in Italy is that the growth outlook is the absolute worst of the major EMU nations and has been for a very long time. In a recent note, Albert Edwards of SocGen noted this depressing fact:

“I had a very long chat with our Italian economist, Vladimir Pillonca. He says one single variable encapsulates the depth of Italys economic problems: GDP per capita is lower today than it was a decade ago – one of the worst performances among advanced economies” in the IMF’s words.

The real issue is Italys incredibly low productivity growth (see top right-hand chart above). Hence, having been in excess of 2% yoy in the late 1990s, Italys trend GDP growth rate is now barely positive on Vladimirs estimates.”

The math just doesn’t add up here. Even if the country can right its bloated debt issue, they are unlikely to grow their way out of this debt crisis any time soon. In fact, given the austerity measures the odds of them achieving their growth targets are remote. I continue to think that Europe underestimates the gravity of the situation here. They have to be realistic with themselves. In order to resolve this crisis you must eliminate the solvency issue at the sovereign level. The only way to achieve this is via a fiscal union or the re-implementation of the old single currencies. The latter would likely involve the partial or complete destruction of the Euro and would, in my opinion, be a disastrous situation for Europe and the global economy. The former, unfortunately, involves choosing Euro national pride over individual country pride. Easier said than done….

Unfortunately, the Germans are in the driver’s seat hoping the situation will fix itself so they can go along their merry way with record low unemployment and decent relative growth. What they don’t seem to understand is that the wheels are coming off of the car they’re driving and if they don’t act soon the car is certain to crash. Mario Draghi, an Italian, is taking over the ECB. Of all the people in charge, we should hope that he would be able to convince the Germans that the ECB bazooka must be picked up and fired straight into the heart of this crisis….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.