A few months ago I asked a yet unanswered question – “is the USA decoupling from Europe?” My thinking was rather simple. Both regions of the world were/are suffering balance sheet recessions, but the difference is that Europe is imposing austerity while the USA is running large budget deficits. That meant the US economy was unlikely to be dragged down by the Euro crisis. Back in December I said:

“The United States, on the other hand, has been running steady 10% budget deficits throughout the last 3 years – there has been no real austerity. This has helped the private sector de-leverage without crushing economic growth. I’ve maintained an unpopular position over the last few quarters that the USA would “muddle through” as opposed to falling into recession. This position has been based on my idea of a continuing balance sheet recession in the USA combined with a government that, despite its inability to agree on most things, has not torpedoed the economy via austerity.”

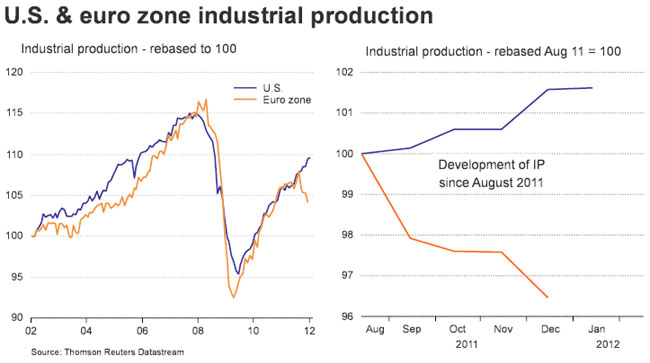

The latest industrial production data shows how this decoupling has indeed occurred (via Reuters):

“Until recently, that is. As the chart on the right shows, the recent crop of crises among countries on the periphery of the eurozone – most dramatically Greece, but also Ireland, Portugal, Spain and Italy – has caused industrial production to plunge in the eurozone as a whole. Ironically, at the same time, the same data in the United States has rebounded, helping to fuel confidence in the US economy and fueling the recent stock market rally. So, on a relative basis, the U.S. economy looks particularly robust, while the modest gains reported by France and a small slide in growth announced by Germany have been more than offset by the economic slump on the part of the eurozone’s laggards.”

Will it continue? It’s certainly hard to imagine that things in Europe will change any time soon. As I’ve recently said, I don’t think the crisis in Europe is over by any means. But I do still believe the US economy is healthier than most believe….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.