This note by Ray Dalio was going around the last few days explaining how the “debt supercycle” is nearing its end. He says:

“the risks of the world being at or near the end of its long-term debt cycle are significant.”

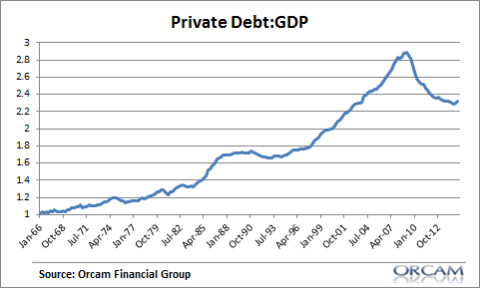

Now, there’s no doubt that aggregate debt as a percentage of GDP has increased substantially. According to McKinsey total global debt as a % of GDP has climbed from 246% in 2000 to 286% in 2014. But a big part of that increase is the fact that there isn’t enough private sector borrowing. In fact, one of the primary causes of the weak recovery is a lack of private debt demand. Regulars know my long chronicles of the consumer credit crisis over the last 7 years.

And when we look at the private credit markets we see that the debt supercycle ended in 2007. Total global private sector debt as a % of GDP has increased from 203% to just 204% in the last 8 years. It’s even worse when we look specifically at the USA. Private debt peaked long ago and has fallen all the way back to levels last seen in 2003. Household debt as a % of GDP has fallen from its peak of 96% back to 77%. Again, it hasn’t been that low since 2003. And that was right around the period when the consumer was getting ready to leverage into the biggest credit crisis in a century.

I don’t think Dalio’s description fairly captures the current environment. What we’ve seen in the last 7 years is a huge expansion in specific country debt (like China) and government liabilities. And any regular reader knows that government debt can’t be properly compared to household debt because countries generally have a tremendous amount of flexibility managing their liabilities that private sector entities don’t have.

The debt cycle is extremely disjointed in this market cycle. We’re seeing deleveragings in Europe and the USA, but Asia has been on a different page for a long time. And we’re starting to see signs that the pages are turning there. Clearly, this is bad news for China, but it doesn’t necessarily spell doom in the USA. The US private sector is starting to leverage back up and now China appears to be deleveraging. And that’s one reason why this might all turn out better than a lot of people think. After all, if the US consumer starts releveraging again then that could just be enough to offset much of the weakness in other parts of the world.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.