Here’s some interesting commentary from Moody’s on the different views of the markets by through the eyes of credit and equity. They cite several different disconcerting divergences including the difference between the VIX and the high yield bond spread, CEO expectations, and the collapse in capital goods orders (via Moodys):

“Compared to corporate credit, the equity market may now have the greater proclivity to fantasize. Consider the recent divergence between a well-below average, and thus confident, VIX index and a well above average, and thus anxious, high yield bond spread. Ordinarily, these frequently cited measures of perceived market risk are in agreement, but not now.

Since 1989, the medians of economic recoveries prior to the Great Recession were 17 for the VIX index and

426 bp for the high yield bond spread. Unlike the VIX index’s recent exceptionally low reading of 14.9, the accompanying high yield bond spread of 577 bp was far above its mid-point of previous recoveries.Apparently, the equity market is relatively confident that (i) global stimulus will prove effective, (ii) European business activity will improve, (iii) a disruptive oil price shock will be avoided, (iv) markets will be pleased with the outcome of the November elections, and (v) the US fiscal cliff will be satisfactorily resolved. As they say, hope springs eternal.

CEOs seem to be at odds with their shareholders

How odd that just as the equity market shows increased confidence in the future, the Business Roundtable’s

business outlook index of 2012’s third quarter sank to its lowest reading since the first quarter of the current recovery, or Q3-2009. Moreover, not once during the five-years-ended Q2-2008 were surveyed CEOs as pessimistic as they were during Q3-2012. Getting down to specifics, a relatively low 58% of Q3-2012’s surveyed CEOs expected sales to grow over the next six months, while only 30% planned to increase capital spending and merely 29% expected to add to payrolls over that same span.CEOs were not alone in taking a more cautious view of capital spending. An index of planned capital

spending by manufacturers in the District Federal Reserve Banks of New York, Philadelphia, Dallas and

Richmond also sank from the second to the third quarter. In Q3-2012, this index was less than half of what

it averaged during June 2004 through June 2007.Capital goods orders plunge

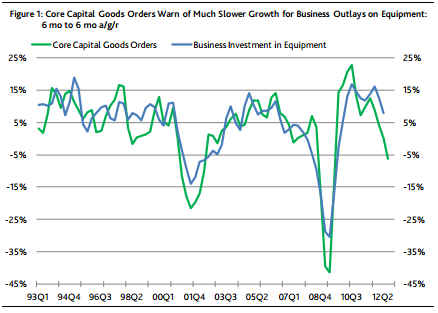

Worry over the adequacy of global growth and concerns regarding the November elections and fiscal cliff

have put businesses on the defensive. During the three-months-ended August 2012, new orders for

nondefense capital goods excluding aircraft, also known as core capital goods, contracted by nearly 18%

annualized from the contiguous three-months-ended May 2012. That was the worst such setback since the

nearly 21% plummet of the three-months-ended May 2009. In addition, the latest 4.9% year-over-year

drop by core capital goods orders warns of a pronounced slowing by business investment in equipment from its 11.3% yearly advance of Q2-2012. (Figure 1.)”

These discrepancies are occurring with increasing frequency. But it seems the equity markets are confident that the Fed will keep asset prices “higher than they otherwise would be”.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.