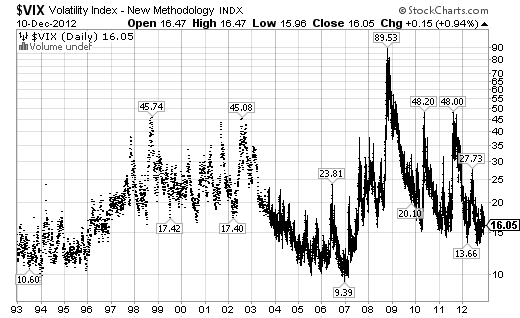

In the last 5 years several indicators have become extremely popular. Perhaps none more so than the VIX. That is, the volatility index. The VIX is a measure of implied volatility for the S&P 500. It’s also known as the fear gauge as it has a tendency to correlate decently with big moves in the market. The only problem is that this index doesn’t tell you much except in rather extreme environments. In fact, that might even be a stretch.

Anyhow, I was intrigued by these comments in a JP Morgan note recently which state that current economic indicators are consistent with much higher volatility (using a 100 year average):

“To compare the current VIX levels to macro fundamental risk, we have performed a simple quantitative exercise: we compiled a list of 484 macro indicators published by Bloomberg that have a significant correlation to the VIX index and regressed them against the current reading of the VIX. Results show that the current low VIX level is in stark contrast to virtually every macroeconomic indicator across the globe. These indicators include PMI, GDP, payroll and unemployment, housing, retail sales, consumption, inventory, business and consumer confidence, delinquencies, and other economic activity indicators. The 81 US macro series point to a VIX level on average 7.2 points higher, the 214 European indicators point to a VSTOXX level 9.7 points higher, and the 186 Asia economic indicators point to a VNKY level 8.9 points higher (Figure 8). While these results don’t signal an imminent increase in the VIX, they do point to a large discrepancy between the market volatility and macro fundamentals. As we do not think that the macro environment will drastically change over the next year, we believe risk for market volatility is to the upside.”

Don’t call me skeptical. Call me more of a reversion to the mean kind of guy. A brief glance at a 20 year chart of the VIX shows that we could actually go a lot lower in this index and that we’re still very much in an environment of persistent fear. So I say wake me up when this index does something that sends us shooting (in either direction) away from the mean. As opposed to what looks like a big coin flip here….After all, the fun in mean reversion is gone once we’re sitting right at the mean…

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.