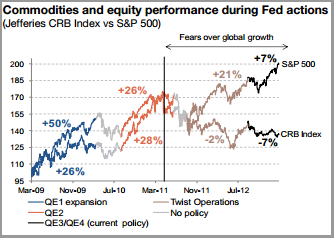

Here’s an interesting point via SocGen that I haven’t seen many people discuss. Notice in the chart below how commodities have stopped responding to the QE effect while equities have not:

“The effect of QE on commodities (if any) vanished earlier than for equity markets. During each of the first

two quantitative easing phases carried out by the Fed, commodities appreciated by over 25%. However, following the announcement of QE3 in Sept. 2012, commodity prices declined (-7% for the CRB index), a reminder that they remain largely driven by economic cycles rather than central bank actions (Gold being the notable exception). In fact, equity markets now seem to be the only asset which benefits from abundant central bank liquidity.Conclusion: The all-time high reached by US equity markets last week can be attributed to the fact that the only major asset class which benefits from the current “risk-on” mood of investors is equities in developed market.”

It all makes you wonder – is there a real fundamental driver behind QE or is it mostly psychological as I’ve been saying for a long time now? How could such a dramatic disconnect exist if there is so much more money in the system chasing fewer and fewer asset classes? Could it simply be that there are other real fundamental drivers of stock prices at present (like corporate profits being driven in part by huge government deficits?) and that the QE “wealth effect” is all in our heads?

(Chart via Societe Generale)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.