Closet indexing occurs when a high fee mutual fund or ETF promises to be able to “beat the market”, charges a fee premium relative to its benchmark and then largely mimics the performance of the benchmark. This is a tremendous problem for investors because they usually end up paying hefty fees in exchange for empty promises. When I review client portfolios I find that an alarmingly high number of them hold closet index funds (before I release these demons into the netherworld).

I bring this up in response to a piece today on Morningstar titled “In Defense of Closet Indexers”. The subtitle is “They are no worse (or better) than other forms of active management”. There are two issues here I’d like to highlight:

- The false dichotomy of “passive” vs “active” creates confusion from the start. The financial industry seems very confused on this subject thanks to unclear academic literature on the topic. We tend to assign the term “active” to funds that are literally more active. By this definition Warren Buffett is a “passive” investor because he doesn’t often change his portfolio. This is obviously ludicrous. The correct definition of passive is a strategy that tries to capture the market return vs the active investor who tries to be able to beat the market return. But since we all deviate from global cap weighting (the one true benchmark of outstanding financial assets) we are all active investors. In a world of low fee indexing this distinction has become increasingly muddled by market commentators. The Morningstar article defends high fee active management based on a false dichotomy. This debate is not about “active” and “passive”, it is about the efficiency in which we are active.

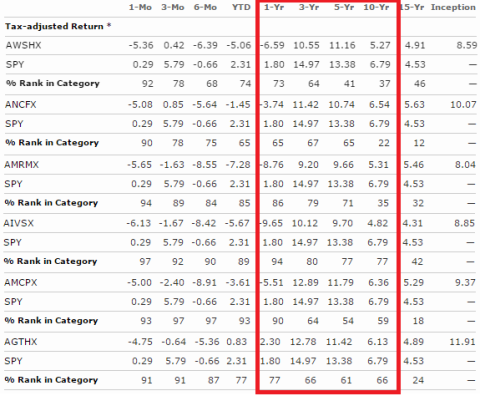

- The core of the defense in the article is the fact that four of American Funds’ U.S. stock funds have bested the S&P 500 over the last 15 years. This is true, but none of them have bested the S&P on an after tax and fee basis in the last 1, 3, 5 or 10 years. In fact, many of those funds have dramatically underperformed after taxes and fees over these periods as you can see in the figure below (I wasn’t sure which funds he was referencing, but the following six funds are US equity heavy). So yes, if you had the foresight 15 years ago to pick those funds then you “beat” the S&P 500, but if you were an investor who bought one of these funds any time in the last decade you bought a fund that gave you 95% of the S&P 500 correlation with a lower after tax and fee return. And given the propensity for investors to chase returns it’s almost certain that the vast majority of the people who own these funds have not captured that 15 year outperformance. In other words, most of the investors in these funds have invested in a closet index and not benefited.

In general, I agree with the cited academic paper referring to closet index funds as a “gigantic mis-selling phenomenon”. I don’t think we should ban these funds as the paper asserts, but I do think we need to properly assess this problem so investors can make better informed decisions. We still siphon way too many billions of dollars into investment firm coffers for no good reason. That’s money that is directly harming your retirement and livelihood. There is no practical defense of this.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.