I’ve seen some economists (like the Market Monetarists) trying to claim that we’re undergoing a harsh fiscal austerity. In doing so they can try to claim there’s harsh austerity going on and that QE and monetary policy has kept the economy afloat.

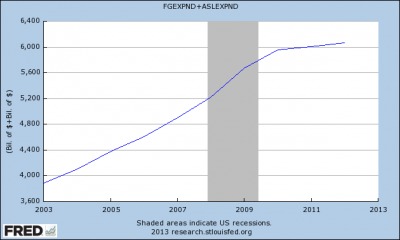

First of all, aggregate government spending has not declined. In fact, it is rising. We can rearrange the definitions of “austerity” depending on how we want to frame the debate, but I wouldn’t call a continued rise in current expenditures “austerity” like I would claim that what’s going on in Greece has been austerity (where government spending has actually declined 25%+ since its highs). Anyhow, here’s the current expenditures in the USA at the State, Local and Federal level:

Second, if we look at why the budget deficit is declining you’ll notice that it’s not the result of government imposed austerity and reductions in spending, but increased tax revenues due to higher incomes and capital gains. In other words, the deficit is declining because the private sector is healing and the Balance Sheet Recession is ending (which is precisely what I predicted would happen several years ago). The hand off isn’t complete, but the government hasn’t dropped the baton by any means and it certainly hasn’t imposed harsh austerity.

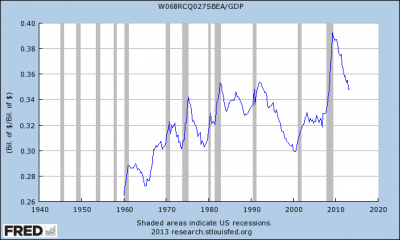

Addendum – Reader “Circuit” points to the “right” way to calculate austerity according to Dr. Krugman. He says we should use total govt spending divided by potential GDP. I disagree. Potential GDP is largely a construct of NAIRU based models and estimates of some sort of “optimal” form of GDP. It represents little more than guesses about what an economy has the potential to produce rather than what is has actually produced.

If we show total government spending relative to actual nominal GDP then the story looks totally different. Yes, as a percentage of GDP we’ve seen some decline, but we’re still at levels never seen before the crisis. Is that austerity in historical terms? Sure, but only if down is up.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.