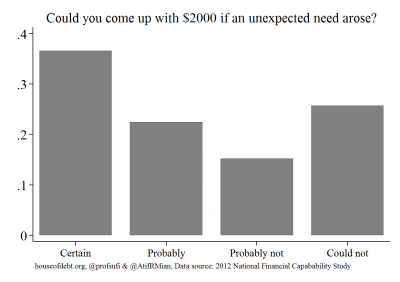

After 5 years of de-leveraging it sure feels like things are better, right? The debt to income ratio has fallen from 1.15 to 0.9. Stocks are soaring. Corporate profits are at all-time highs. Things seem pretty good. But underneath all of this there’s a lurking fragility that remains from the credit crisis – household balance sheets are still pretty weak. Take this horrifying statistic (from House of Debt):

“Almost 40% of individuals in the United States either could not or probably could not come up with even $2000 if an unexpected need arose.”

This is, in large part, why the 2008 credit crisis was so damaging. Even minor disruptions in the economy can cause big problems. And problems send us on the verge of a crisis because the consumer is on such tepid footing. Yes, the Balance Sheet Recession is behind us (households are now re-leveraging), but the future remains very uncertain as households continue to cautiously manage their fragile balance sheets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.