It’s no secret that I think the BOJ is making a mockery of the Japanese stock market and is in the process of implementing extremely dangerous policy. This form of explicit asset price targeting puts the cart before the horse and misunderstands the role of secondary markets, in my opinion. And now the upside volatility is coming home to roost as the Nikkei is off a quick 16%+ from its recent highs in what looks like the “poverty effect” that inevitably reverses a “wealth effect” built on quick sand.

As Sober Look notes, Nikkei volatility is now at its highest levels since the Fukushima Nuke disaster. This shouldn’t be terribly shocking. Trying to stabilize and control inherently volatile asset classes is not unlike trying to tame a tornado. And that’s a big part of the equilibrium based economics so many economists rely on these days. The economy is not a linear or stable system. It is in a constant state of disequilibrium which can often be made even more unstable when policy is misguided.

So, where to now? Todd Harrison over at Minyanville had some nice thoughts on the reasons for the latest market swoon and asks the all important question for Japan – is it really different this time:

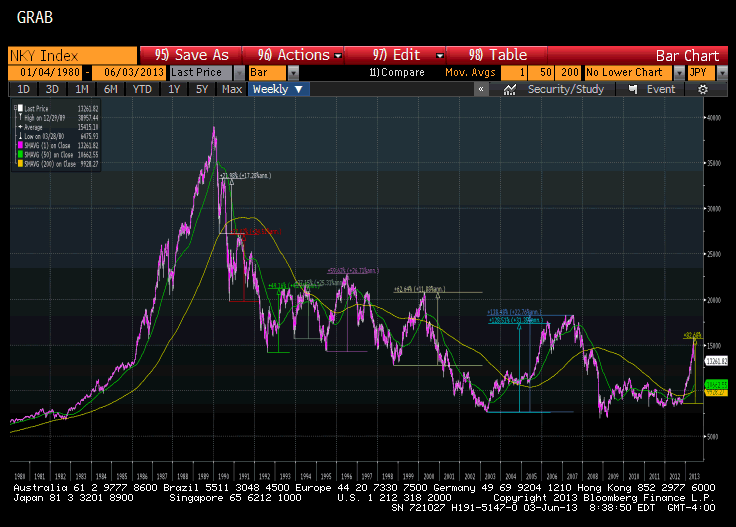

“This time is different for Japan, right? Well, maybe. Since the Nikkei stock market bubble burst on New Year’s Day 1990 — at a level of almost 40,000 — we’ve see rally attempts of 22%, 37%, 50%, 36%, 60%, 62%, 138% and most recently, from November of last year until late May this year, 84%.”

(Nikkei Index 1980-2013)

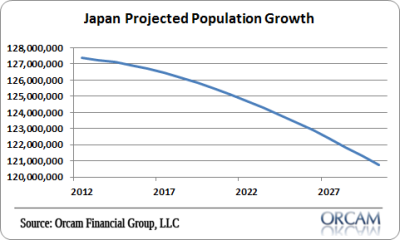

Is it different this time? Sure, when Abenomics solves the problem below then maybe it will be different this time…..Until then, Japan’s problems continue to be structural and ones that government are unlikely to resolve through tough talk and QE.

(Japan projected population growth)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.