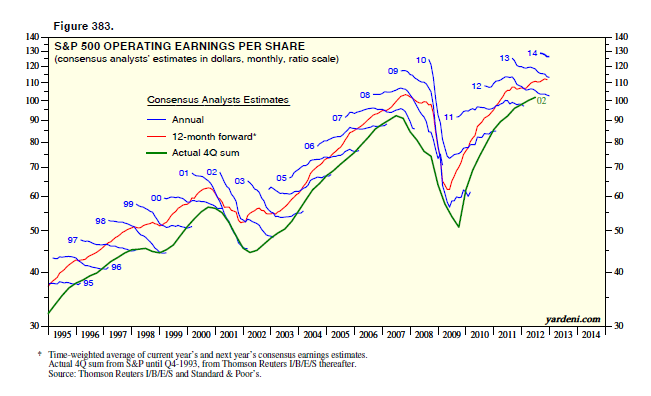

This is a great chart from Ed Yardeni. It shows a 20 year history of analyst’s estimates and how poorly the estimates have held up over the course of each year. As you can see, analyst’s estimates have fallen during the year in 16 of the 20 years. In other words, the estimates are revised lower in most years as analysts are forced to cut estimates.

Having had a significant amount of experience in this field, I presume there’s a bit of cat and mouse here as corporate America tends to play the analysts by feeding them low estimates and then beating the estimates. But as another earnings season approaches we have to all question the significance of what will certainly be a recurring headline in the coming weeks:

“ABC company beats expectations!”

Here’s more from Dr. Ed:

I track the industry analysts’ annual consensus earnings estimates of the S&P 500 for the current year and the coming year on a weekly basis. I call them “Earnings Squiggles” because that’s what they look like. As of last week, industry analysts estimated that the S&P 500 will earn $112.98 this year and $125.91 in 2014.

The estimates for 2012 and 2013 mostly fell all last year, yet the S&P 500 rose 13.4%. I have the Squiggles data back to 1979 on a monthly basis. More often than not, they tend to trend down; yet more often than not, the market has trended higher. That’s because the market discounts 12-month forward consensus expected earnings. A good proxy for this concept is forward earnings, i.e., the time-weighted average of consensus estimates for the current and coming years. It tends to be a good 12-month leading indicator for actual profits, with one important exception: Analysts don’t see recessions coming until we all do too.

The bottom line is that the bottom line for S&P 500 companies on a 12-month (and on a 52-week) forward basis rose to a record high at the beginning of this year even though analysts have been lowering their estimates for 2012 and 2013.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.