The most difficult part about managing assets is the constant roller coaster ride of emotions. I don’t just carry the burden of my own emotions around with me. I have to be mindful of the emotions of every person I work with. It’s a lot to handle especially during times like these when the markets are so jittery and Greece and China appear to be blowing up around us.

That said, one of the hardest parts about investing is keeping these irrational fears in check. And yes, the vast majority of the time these fears turn out to be irrational. In my view, this appears to be one of those cases. Despite some worrying foreign trends I just don’t see much changing here at home in terms of the overall picture. As a case in point here are three broad macro data points that support this thinking.

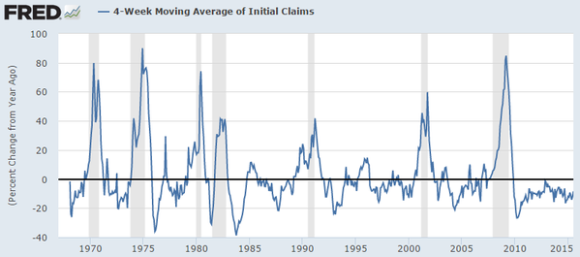

1) Jobless Claims just keep on chugging (and by chugging, I mean plunging). Jobless claims have reached their lowest levels in over 40 years. This is one of the very best indicators of real-time economic data. Of course, one might be inclined to argue that jobless claims trough just when the economy is at its strongest. Yes, this is true, but here’s another fact – we have never had a recession in the USA without jobless claims spiking 20% year over year. Jobless claims are usually one of the first indicators to tell us we’re in a recession. The second, of course, is the NBER and they won’t let you know until about 6 months after claims do. As of now, claims are still declining at an annualized rate.

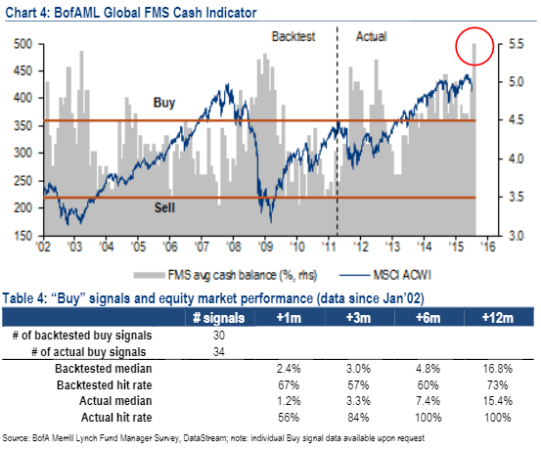

2) Cash levels point to a buying opportunity. Bank of America Merrill Lynch recently posted this indicator showing asset manager cash levels. Historically, when cash levels jump to 5.5% the market is consistent with extreme fear. The median return over a 1, 3, 6 and 12 month period is positive on average following such fear levels. Most impressively, the equity markets are up 16.8% on average one year later.

Of course, it’s pretty difficult to rely on historical indicators like this because each market cycle is always unique, but you know what they say – be fearful when others are greedy and be greedy when others are fearful. Now looks like one of those fearful times.

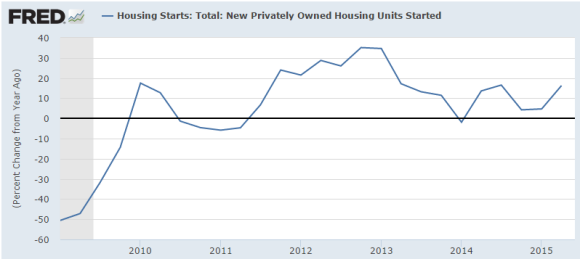

3) Is housing finally gaining some traction? The biggest reason this recovery has been so weak is due to the weak housing market. The stagnant recovery in housing has dragged down the entire economy for the last 7 years. But the housing data in the last few months has been rather robust. Here in California it feels like things are starting to really boom again. Rents are rising, new construction is everywhere, remodels are all over the place and housing starts are catching fire again. At a rate of 16.2% Q2 was one of the strongest quarters of the recovery.

If housing is starting to pick up momentum here we could enter the back half of 2015 having a mighty huge laugh at all the China and Greek worries.

* In fairness (and to challenge my own views) I will post three bearish charts tomorrow.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.