You didn’t think I was going to let you go into the weekend all depressed now did you? I mentioned last week that the recent downturn in stocks appears to be a purely non-USA event. That is, the US economic data that’s been coming out in recent weeks really looks no different than anything we’ve been seeing for the last few years. Specifically, we saw three of my favorite macro indicators this week all come in at record high levels or strong levels.

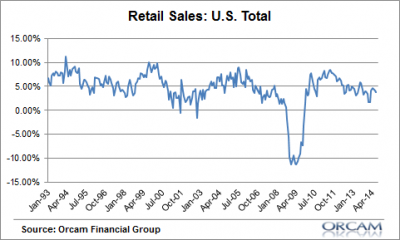

Retail sales missed expectations on a monthly basis, but are still growing at a 4.5% annual clip. Healthy by any standard:

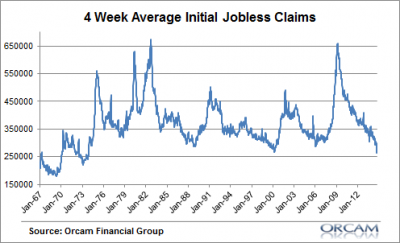

Initial jobless claims fell to a 14 year low:

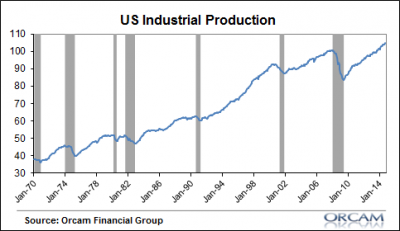

And industrial production hit an all-time high:

Now, the stock market isn’t the economy so it’s not surprising to see temper tantrums every now and then, but I don’t see much of an excuse for a prolonged downturn in equities at this point based on the macro view of the US economy….Sure, some foreign weakness might creep into the balance sheets of US corporations, but a modest expansion in future earnings hasn’t been altered by recent events. Of course, if some draw dropping change came out of the EMU (like a Greek restructuring of the monetary union) then my views would be void of value, but I don’t see that happening any time soon. If anything, we’re more likely to move in the direction of more Central Bank intervention as opposed to a restructuring of the system.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.