The latest edition of some things that I think I am thinking about:

1) The US economy sure looks anemic. Q1 GDP is expected to come in at 1.2%. My own metrics show even lower growth possibly nearing 0.5%. But the Atlanta Fed notes that Q1 has been weak throughout the recovery:

The picture below illustrates the vice chair’s sentiment. Output in the first quarter has grown at a paltry 0.6 percent during the past five years, compared to a 2.9 percent average during the remaining three quarters of the year.

They blame the weather or other statistical anomalies. But it’s actually true. The weather has had an outsized impact in Q1 during this recovery. And every time it happens we see a huge number of articles complaining about how “the weather” is some phony excuse hiding stronger growth. And then the subsequent quarters end up showing that the weather might have actually played a significant role. Is it different this time? I don’t know, but my leading indicators aren’t pointing to a recession in the USA just yet so I while I am not highly optimistic about growth (we’re still muddling out of the balance sheet recession) I wouldn’t be surprised if the Atlanta Fed isn’t on to something here….

2) Marc Chandler asks if contagion is returning in Europe. His chart of the day shows peripheral bond yields all rising in unison again which is a sign that bondholders are worried of a potential domino effect:

Honestly, I can’t believe we’re still talking about Greece. And the thought of a Grexit with potential chain reaction is just unimaginably stupid if it’s allowed to occur. That said, by now I hope your portfolio is well insulated against such a tail risk event. If there was ever a gigantic risk to the financial markets that was so clearly telegraphed then this is it.

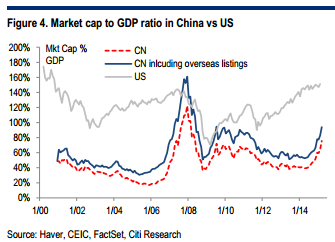

3) I was intrigued by this chart of market cap to GDP in China and the USA:

There’s been so much bubble talk in China recently that this chart makes me wonder – which market is actually the bubble? Or, why are we even calling this stuff bubbles when so many people seem to be calling so many things bubbles these days? Or is it just that all of these macro valuation metrics are a lot more worthless than people think? As you likely know, I am inclined to go with the latter….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.