Here are some things I think I am thinking about….

1. Americans are financially illiterate. Here’s a scary statistic from the Wall Street Journal and S&P:

Just 57% of U.S. adults passed this test.

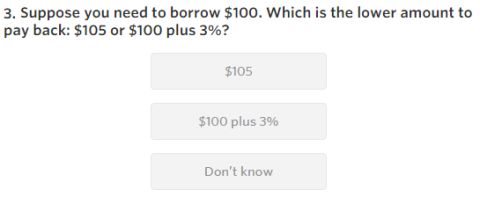

This is a test that includes questions like this:

Gulp.

2. How about this stock market? Despite persistent worrying about Greece, China, rate hikes and countless other items the US stock market is just shy of its all-time highs. It’s amazing how resilient the market has been through all of this. Then again, at the end of the day, not much has changed. We’ve been worrying ever since 2008. And while there are pockets of very real concern we should be clear that it is pockets. For instance, we’re in the middle of an earnings recession. But this earnings recession is almost entirely due to the energy sector where fiscal year 2015 earnings are estimated to decline by a staggering -58.5%. If we exclude the energy sector the 2015 earnings growth rate comes in at 6.9%. That’s pretty healthy. And it goes to show just how much one sector is dragging down the whole market.

Here’s something to consider though. If 2015 stumbles to the finish those year over year comps in energy are going to become low hurdles to jump over next year. Even a marginal rebound in energy prices will lead to huge gains in earnings. That could make 2016 look a lot rosier than some expect. As I said back when people were jumping out of windows in August, this market looks a lot more like 1998 than 2008….

3. We are still very early in the information age. In all of this sea of pessimism here’s something that will put current tech trends in perspective. Now, it might seem like the internet is something that’s been around forever. It sure feels like it’s been around as long as I’ve been alive. But we’re still talking about a remarkably young technology. For some perspective, here’s e-commerce sales as a percentage of total retail sales:

That’s right. 7.4%. Just 7.4%. Now, I have no idea where that figure will plateau, but if I had to guess I would say that that trend is far from ending. After all, look how new the whole e-commerce segment is. We’re talking about a segment that has grown from nothing to 7.4% in 15 years. We’re so early in the information age that it’s hard to imagine what we’ll be doing in 25 or 50 years. But it will be exciting as hell to find out (well, not “hell” like the place horrifically hot place where Satan lives, but you know what I mean).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.