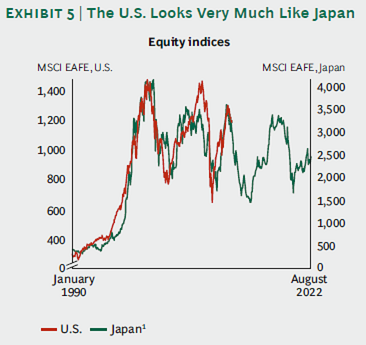

I’ve often said that the US economy is largely following a Japanese path. The natural conclusion is to also conclude that the US stock market is likely to follow a path similar to that of the Nikkei. You’ve probably seen some version of the chart below. Now, I am not a believer in the idea that anyone can predict where stock prices will be more than a quarter in advance, but if I had to venture a guess I would guess that the USA/Japan equity market theory will not hold. Why? Several reasons:

- This is a household balance sheet recession in the USA and not a corporate balance sheet recession as was experienced in Japan. Because their corporations were so excessively indebted their equity market remained weak for many decades as companies paid down debts rather than focusing on profit maximization.

- US corporations remain incredibly diverse and their broad global footprint has allowed them to remain profitable even during this historic downturn.

- US corporations have cut costs massively and are already experiencing close to no growth in domestic revenues. Without a massive collapse in foreign revenues corporate profits are unlikely to experience a decline that would warren stock prices at the 600 level as the Japan comparison might imply.

In short, without some sort of unforeseen catastrophic event in China or Europe I find it hard to believe that stock prices in the USA will follow the Japan story down to the 600 levels…..

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.