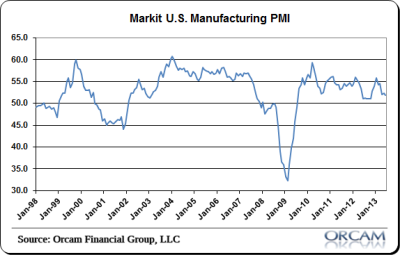

This morning’s PMI report showed mixed signs about the US economy. The Markit US Manufacturing index came in at 51.9 which was down from 52.3 in May. Markit referred to the current environment as a “modest expansion”:

“At 51.9, the final Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) signalled only a modest manufacturing expansion in June.

Having fallen from 52.3 in May, and dropping below the earlier flash estimate of 52.2, the PMI indicated

the slowest rate of growth since last October. The PMI averaged 52.1 in Q2 as a whole. This was down from 54.9 in Q1 and was the lowest reading since Q3 2012.”

Notable improvement came from output, new orders and quantity of purchases. Notable decelaration came in employment and rising inventories. The employment index is of particular interest for stock market participants since it shows that corporate America’s biggest cost isn’t on the rise. This has been a good sign for stocks for years now as the slow, but expansionary economy has helped them grow them top line without having to boost employment costs which might lead to margin contraction.

All in all, it was just an okay report. It likely doesn’t bode well for the employment report later this week, but I don’t know how much the stock market really cares about that so long as we’re seeing modest employment expansion and continued economic growth.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.