This section will be a new addition/clarification to my paper on Understanding the Modern Monetary System.

Modern forms of money are largely endogenous (created within the private banking system), but are organized under the realm of government law. The specific unit of account in any nation deems what money will be denominated as. The government therefore decides the unit of account and can restrict/allow certain media of exchange. The unit of account in the USA is the US Dollar.¹ Organizing money under the realm of law increases a particular form of money’s credibility in the process of transaction. The government also helps oversee the viability of the payments system and can decide what can be used within that payment system as a means of settlement. In the USA the primary means of settlement are bank deposits and bank reserves. Therefore, these forms of money serve as the most widely accepted forms of payment within the money system.

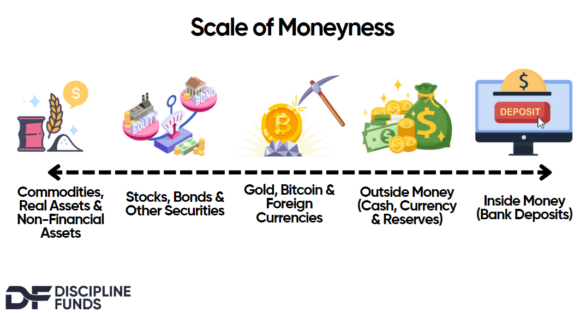

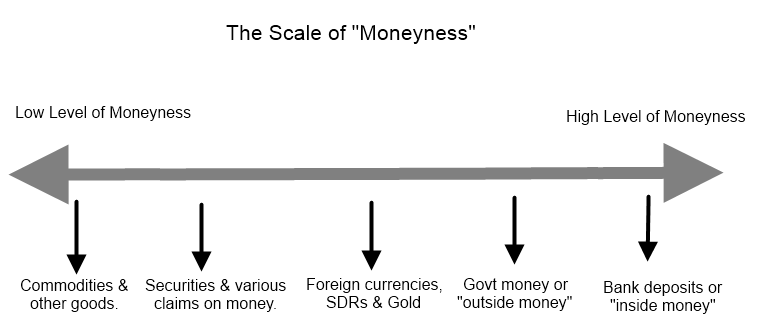

The concept of money is tricky in the sense that money mostly exists on a scale. There are different forms of money within any society and they have varying forms of importance and “moneyness”. Moneyness can be thought of as a form of money’s utility in meeting the primary purpose of money which is as a medium of exchange or a means of final payment.

In the USA the money supply has been privatized and is dominated by private banks who issue money as debt (which creates bank deposits). Banks are granted charters by the government in the USA to maintain the payments system in a market based system. Banking is essentially a business that revolves around helping customers settle payments. So it’s helpful to think of banks as being the institutions that run the payments system and distribute the money within which that system operates. Outside money (or money issued OUTSIDE the private sector – notes, coins and reserves) plays an important role in helping facilitate the use of the payments system, but primarily plays a supporting role to inside money (money created INSIDE the private sector such as bank deposits) and not the lead role.

Outside money could theoretically serve as the most dominant form of money in the system (for instance, if the government did not choose to use bank money to spend, but instead chose to simply credit accounts by issuing money directly), but takes a back seat to inside money by virtue of design. That is, outside money always facilitates the use of inside money by serving as a support feature for inside money. Cash, for instance, allows an inside money account holder to draw down their account for convenience in exchange. Bank reserves help stabilize the banking system to serve interbank payment settlement. These are facilitating roles to inside money. Therefore, we place inside money as having the highest level of moneyness in the monetary system.

Inside money and outside money, however, are not the only types of money that exist in the money system. It is helpful to think of money as existing on a scale of moneyness where particular forms of money vary in degrees of utility (see figure 1). As Hyman Minsky once stated, anyone can create money, the trouble is in getting others to accept it. Getting others to accept money as a means of payment is the ultimate use of money. And while many things can serve as money they do not all serve as a final means of payment.

Since currencies are fungible on a foreign exchange market most foreign currencies have a moderately high level of moneyness. For instance, a Euro is not good in most stores in the USA, but can be easily exchanged for US Dollars of various forms. SDRs and gold, which are broadly viewed as universal mediums of exchange, can be viewed similarly though they vary in degrees of convenience for obvious reasons. Gold for instance, is widely viewed as money and can be easily exchanged for money, but is not widely accepted as a means of final payment.

Most financial assets like stocks and bonds are “money like” instruments, but do not meet the demands of money users in terms of having high liquidity or acceptability as a means of final payment. These financial assets are easily convertible into instruments with higher moneyness, but are not widely accepted as a final means of payment. Therefore, their “moneyness” is relatively low.

Lastly, most commodities and goods are low on the scale of money since they are unlikely to be accepted by most economic agents as a means of final payment.

NB – The concept of “money” being acceptable as a means of payment is related to its credibility within a certain system. Typically, an instrument is more money-like when it has a very high degree of credibility and a duration of zero. A discussion of par settlement and credit quality is intertwined here, but that’s for another day.

¹ – Unit of account is a confusing subject. It is not a specific item or financial assets. Rather, it is much like a unit of measure such as inches or meters. In the USA we use the Imperial Measurement system. In the UK the Metric System is preferred. These systems create a uniform way of measuring certain items. Currencies are similar in that they create a uniform way to measure economic variables.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.