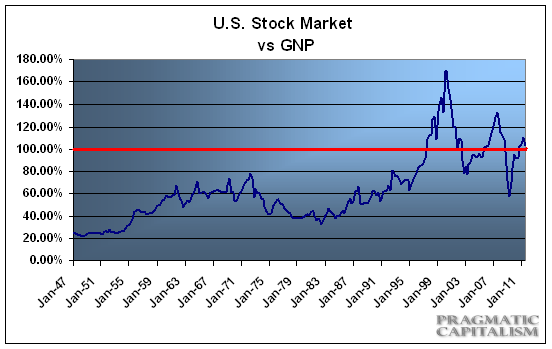

The latest reading on Warren Buffett’s favorite valuation metric shows a bit of a decline, but still elevated levels. The latest reading of 105% is still consistent with a market that is overvalued and unattractive from a pure value standpoint. In the past, Buffett has said that he prefers to see this metric at 70%-80% before buying equities:

“For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000– you are playing with fire.”

Clearly, we’re far from a level where equities are highly attractive according to this indicator.

See here for more on this metric.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.