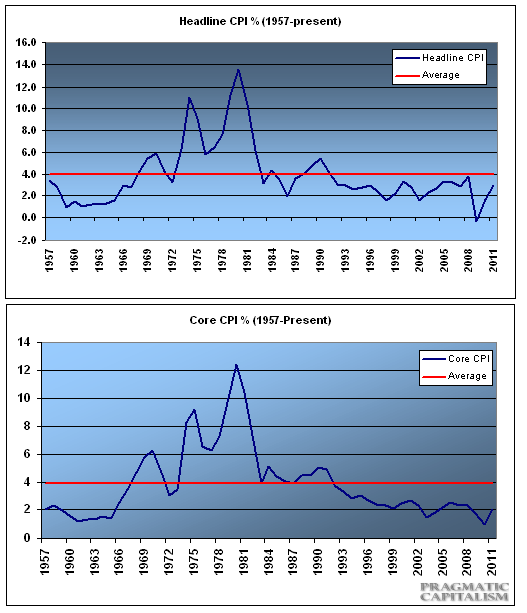

Some of the recent inflation data is causing consternation in some corners of the investment world. At 3.8% headline inflation sounds rather high. But if we study the post-war era, inflation is still low by any measure. If we look at the data going back to 1957 we actually find that headline inflation has averaged just 4% per year. Through the first 8 months of 2011 inflation has averaged 3% – nearly a full 1% below the historical average (latest reading was 3.8%). If we look at core inflation, the picture looks even less alarming. Core inflation is currently running at just 2% while the average since 1957 is 3.9%.

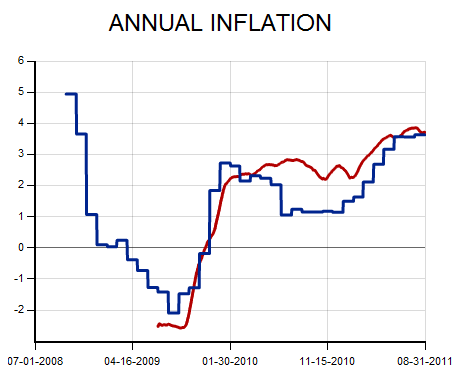

Now, some people will refute this data by claiming that the government’s CPI is flawed or misleading. But we know from the Billion Prices Project AND the ECRI’s independent inflation gauge that the government’s data is actually quite accurate. In fact, the BPP is a near perfect reflection of the government data over the last few years while the ECRI is showing declines in inflation:

(BPP Inflation)

The more important point here is that the inflation risks are now skewed to the downside following several quarters of rising prices. Admittedly, inflation has run hotter this year than I predicted (3% vs 2.5% expectations), but as the hyperinflation meme collapses, the global economy weakens and commodity prices tumble (down 10%+ in September) we should see a return of the disinflationary trend.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.