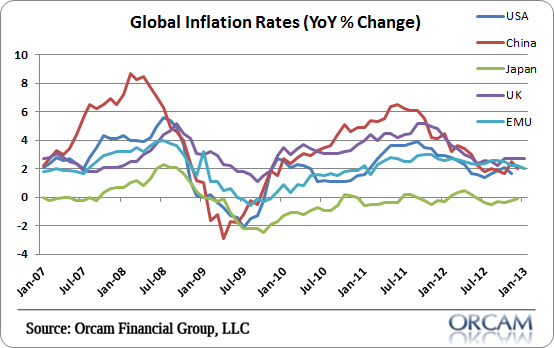

Here’s a follow-up on yesterday’s US CPI release. The following chart shows the year over year changes in global inflation. I’ve included most of the major economies including the USA, China, Japan, UK, and EMU.

Consistent with the rather stagnant global economy, inflation rates appear stagnant as well. It’s clearly not just a US or European phenomenon. And it’s clearly not just a BLS data conspiracy. It’s just a world of low inflation largely due to weak economic environments.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.