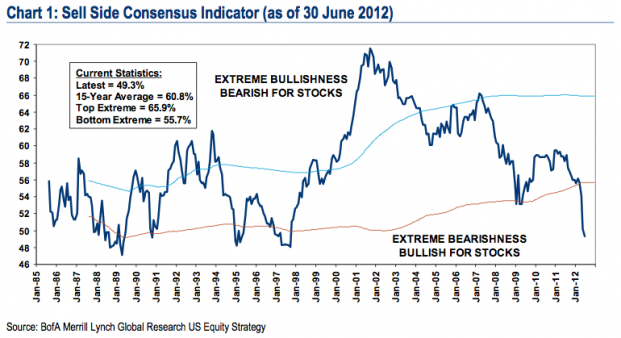

Small investors aren’t the only one’s turning bearish on equities. Apparently, the persistent negativity is spilling over to Wall Street as well as sell side analysts become more bearish than they’ve been in 15 years. According to Merrill Lynch’s sell side consensus indicator just 49.3% of analysts are currently bullish. This level hasn’t been seen since 1998. Merrill Lynch says (via Business Insider):

“After triggering a Buy signal in May, our measure of Wall Street bullishness on stocks declined again, marking the ninth time in eleven months that the indicator has fallen. The 0.8 ppt decline pushed the indicator down to 49.3, the first time below 50 in nearly 15 years, suggesting that sell side strategists are now more bearish on equities than they were at any point during the collapse of the Tech Bubble or the recent Financial Crisis. Given the contrarian nature of this indicator, we are encouraged by Wall Street’s lack of optimism and the fact that strategists are recommending that investors significantly underweight equities vs. a traditional long-term average benchmark weighting of 60-65%.”

Source: Merrill Lynch

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.