Warren Buffett was doing his regular (quarterly?) interview on CNBC this morning and made some interesting comments on the big picture outlook. He said:

“I think there’s no question, that world wide, there is some slowing down going on. Actually, in the USA residential housing is picking up and we’ve been waiting for that for a long time. That will have a significant impact. It hasn’t gotten to a big level yet…the general economy is a little bit better in the US.”

He sees definite slowing in some of his “real-time” businesses abroad which have slowed substantially. Of course, this has also been seen across the board in multinationals and their earnings reports of late.

The more interesting comments were regarding his outlook on unleashing some of the cash hoard Berkshire has amassed. According to CNBC Buffett says prices are “difficult” right now:

“Berkshire has $40 billion in cash on hand, but prices are difficult right now, he said, and Berkshire won’t get into bidding wars.”

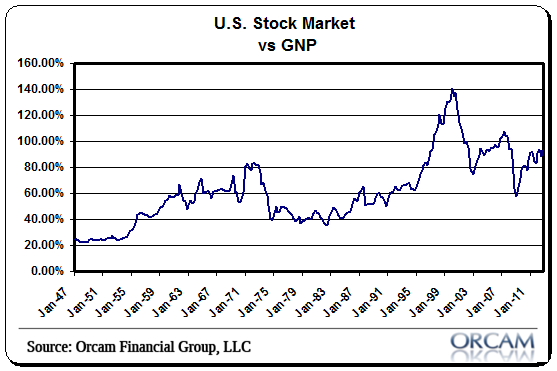

I hate to read too much into his thinking, but I read that as meaning that stocks aren’t priced quite the way Buffett might prefer. That makes sense using his favorite valuation metric. The GNP to total market value is at 93% as of today which is well above the sub-80% level where Buffett likes to do his buying.

(US Total Market Cap vs GNP – via Orcam Financial Group)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.