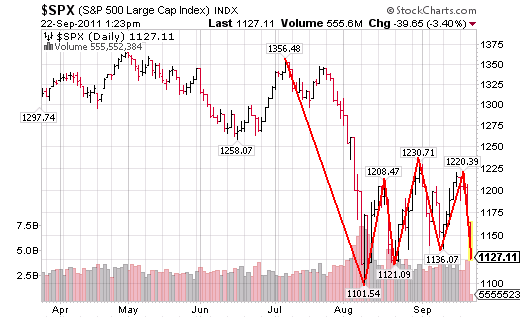

I don’t have much value to add in this story, but I just wanted to point out something that is probably rather obvious, but perhaps not fully appreciated. The last two months have been truly incredible in terms of market action. If you look at just the last 8 weeks we’ve seen a near waterfall 19% decline, followed by a 10% rally, followed by a 7% decline, followed by a 10% rally, followed by an 8% decline, followed by a 7% rally and then the 8% decline of the last two days. Whew.

I still stand by my September 10th comment:

“I would go so far as to say that the risks are so enormous here that the water is simply not worth even dipping a toe into. As investors we have to recognize that we’re in the business of taking calculated risks and not risking capital based on a roll of the dice…”

No one is taking calculated risks at this juncture. The macro picture is in such disarray that anyone betting long/short here is just standing around a spinning wheel hoping they bet on the right color. The speed at which this wheel is spinning though, it might just fly off the table! At least in Vegas they give you free drinks! As Victor Ortiz learned last Saturday night, “protect yourself at all times” – appropriate approach given the incredible market and economic environment we are experiencing…..

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.