I still see a good deal of confusion and debate over the cause of the great financial crisis. To me, this is a crucial understanding because we can’t analyze the disease and study its potential cures if we can’t even identify the causes. Here’s my view of things:

1. In the 2000-2007 period consumers and businesses engaged in an unprecedented housing binge. This was partially fueled by low interest rates and government policy, but was probably more the result of the growing belief that housing is an “investment” and an asset that can be speculated with (see these research pieces, here and here, citing rampant speculation and middle class home buying). Therefore, I would argue that the root cause of the housing boom was more a behavioral change than a structural change resulting from policy changes (though policy aided this change in perception).

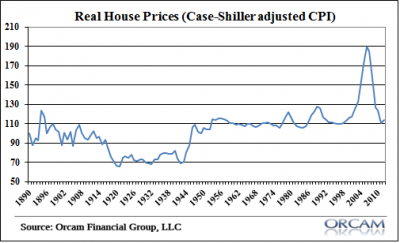

2. This change in perception resulted in an unprecedented boom in housing prices as flippers and speculators began to bet on the myth that housing prices wouldn’t suffer substantial declines.

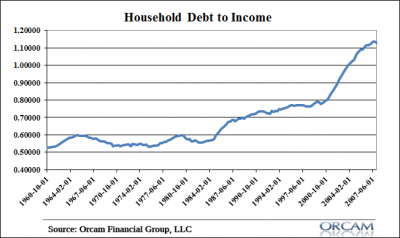

3. To finance this boom consumers engaged in an unprecedented debt binge. They were taking on more debt to finance their speculation. This took the debt to income ratio and aggregate level of household debt to levels that had never been seen before.

This was important because consumer spending is a key driver of the economy and mortgage debt represents 70% of consumer debt. In the period from 2000-2007 household mortgage debt in the USA almost tripled from $3.2T to $9T. Mortgage debt as a percentage of GDP surged from 46% to 76%.

4. This speculation created a ponzi effect. As the bubble grew more debt took prices higher which created equity with which past buyers could borrow more. Even worse, Wall Street was securitizing mortgages and repackaging low grade mortgage products as higher grade mortgage products based on the 50 year data that showed housing prices don’t decline substantially in a calendar year. In essence, you had consumers leveraging up and Wall Street leveraging up on top of that.

5. The boom turns into a bust. The house of cards fell apart when housing prices, the lynchpin in everything, stopped appreciating and began to turn negative. When housing prices turned negative it not only sucked the equity out of the housing market, but it resulted in a big economic downturn in one of the key sectors of the 2003 recovery – the housing and finance industries. The largest asset in the consumer balance sheet (over 25% of net worth) began to deteriorate and the boom turned into a bust. From here, it just took animal spirits to spiral out of control and turn a concentrated downturn into a widespread financial panic. And as the debt was essentially called back in by lenders, the defaults rippled through the economy causing the entire system to seize up.

That’s how I view it anyhow. Maybe you have a different version?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.