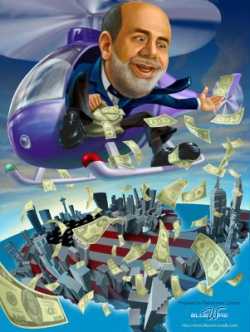

There’s been a lot of ink spilled in recent days about the efficacy of “helicopter drops”. Paul Krugman says they won’t work. David Beckworth makes a similar point. And Brad Delong sounds more optimistic on the efficacy of fiscal policy. It sounds like a lot of talking past one another.

First of all, what is a helicopter drop? A helicopter drop should be thought of as anything that adds to the financial net worth of the private sector. This can potentially be achieved by the Fed or the US Treasury. For instance:

- When the US government deficit spends (spends more than they tax) they are issuing a financial asset (the T-bond) that has no corresponding private sector liability. This adds to the financial net worth of the private sector.

- If the Fed had the authority to just dump cash out on the street (they don’t) then that would be a net financial asset for the private sector.

- If the Fed decides to buy bags of dirt at $100 a pop in exchange for freshly minted cash then they are buying a worthless real asset and issuing $100 in net financial assets in exchange. The Fed does not have the authority to do this.

- And if the Fed decides it wants the S&P 500 to be worth 10,000 tomorrow then they could start buying up S&P 500 futures until the market takes the price there (this would add to the net worth of the private sector). The Fed does not presently have the ability to do this.

- Lastly, there are other less direct ways that this could be achieved. For instance, the Fed could set a specific price on long US government bonds which would increase the price of bonds, reduce interest rates and potentially filter through the economy by boosting investment, borrowing, etc. This could also potentially stimulate the net worth of the private sector, but it is a less direct form of “helicopter drop”.

These are all variations on a helicopter drop. And they can all “work” to some degree. The problem is, we don’t seem to be defining what a “helicopter drop” even is or how relevant it is under the current monetary framework. So, when we discuss helicopter drops we need to acknowledge that budget deficits expand the financial net worth of the private sector and that QE could potentially increase the financial net worth of the private sector through the portfolio rebalancing effect (or other measures). In fact, QE1 was most certainly a helcopter drop because the Fed made a market in assets that were potentially worthless without their intervention. This, you could argue, had a much larger impact on the economy than any fiscal policy, but that’s certainly up for debate. Anyhow, all this “helicopter drop” talk seems to be more of a case of talking past one another.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.