Joe Weisenthal of Business Insider posted a good rule of thumb today that helps quantify the impact of rising oil prices on the US economy. He posts a note from Deutsche Bank that says:

“According to our analysis, a $10 increase in oil prices translates into roughly a 25 cent increase in retail gasoline prices. Every one penny increase in gasoline is then worth about $1 billion in household energy consumption. (In decimal terms, it is actually $1.4 billion.) Therefore, a sustained $10 increase in oil prices translates into $25 billion in additional household energy spending. Assuming this price rise crowds out spending elsewhere in the economy, effectively acting as a tax, means that a sustained $10 rise in oil prices reduces annual real GDP growth by 0.2%.”

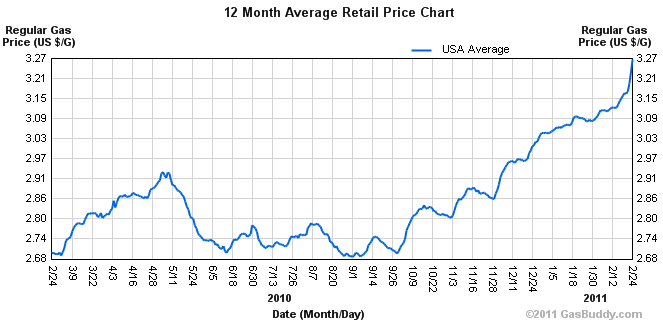

Of course, oil and gasoline prices don’t move perfectly in tandem and the gas market can often work with a lag. For instance, the average national gasoline price is up 21% since September, however, West Texas Crude is up 35%. So the above math doesn’t compute perfectly. If we just take out the following we can begin to grasp how much the increase in gasoline is impacting the consumer:

“Every one penny increase in gasoline is then worth about $1 billion in household energy consumption. (In decimal terms, it is actually $1.4 billion.)”

So, the 21% gas price increase since September has cost the US consumer an extra ~$75B. It’s not surprising that we have seen some signs of weakness in the consumer in the early portion of this year. The bad outcome is if we continue to see gasoline prices surge into the seasonally strong summer driving season. If gasoline prices were to average $3.75 by this summer it would be the equivalent of wiping out the entire tax cut that was recently passed. If prices were to surge back to their 2008 highs it would be the equivalent of a $182B tax on the consumer since QE2 began.

Even worse are the unquantifiable effects. How much does surging gasoline prices alter consumer behavior? How much does oil increase the cost of other products? Can these costs be passed? How does this potential margin squeeze influence hiring trends? No one can really know the extent to which rising oil & gas prices detract from overall economic growth and consumer behavior. One thing we can confirm is that the baseline scenario above amounts to what is effectively a massive tax increase. With a weak consumer we can be nearly certain that this tax will be multiplied through corporate America in the form of margin compression as companies fail to fully pass along any cost increases due to rising oil prices.

In sum, while this isn’t a fatal blow to the economy it certainly doesn’t help the overleveraged and underemployed US consumer. It might not be enough to tip the US economy into recession, but it certainly doesn’t help the tepid growth outlook.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.