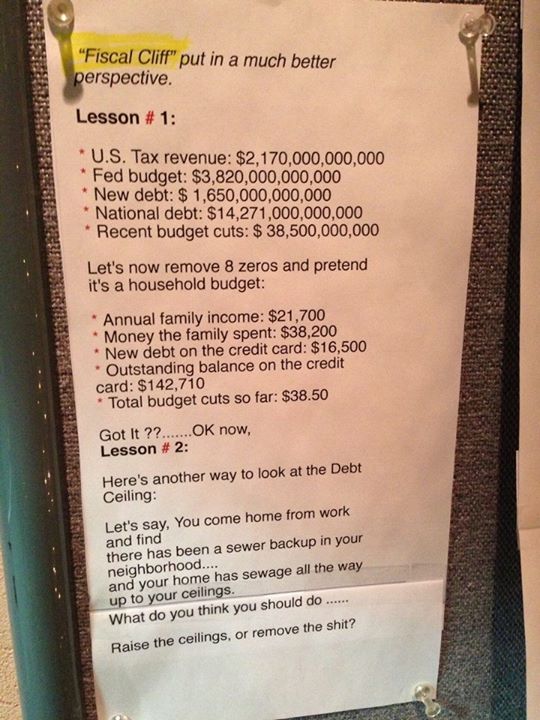

Maybe you’ve seen this image going around the internet? I saw it on Facebook the other day and then again today on Twitter. It shows the US government budget and compares it to a household:

Now, ask yourself the following questions:

- Has your household been alive for 237 years?

- Does your household have the ability to print US dollars?

- Does your household have the ability to sell debt denominated in the same money you print?

- Does your household have the ability to tax other people to generate revenues?

If you answered no to all of the preceding questions then you should also realize that the analogy above is a complete misrepresentation of the way our monetary system functions.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.