That headline probably has you wondering – is there a way hedge funds can evolve in a good way? Of course there is. But this story is troubling recent development that’s the result of a bad evolution in the hedge fund industry – hedge funds and their extremely high correlation to the S&P 500. One of the things that made hedge funds (many of them) so attractive as an asset class was their non-correlation to the S&P 500.

The other day I discussed how the biggest problem with active money managers is that most don’t create any value. And they don’t create any value because they have no competitive advantage. And they have no competitive advantage because they’re not doing anything unique in their strategies. The best funds are not the ones who try to mimic the S&P 500 and happen to outperform them. I can get S&P 500 returns through an index fund. But give me a fund with non-correlation and high risk adjusted returns in a strategy I can’t access through Vanguard and we’re adding value to the portfolio. We’re diversifying risk across different approaches and adding alpha in a way that differentiates us from your standard 60/40 stock/bond fund. That’s value.

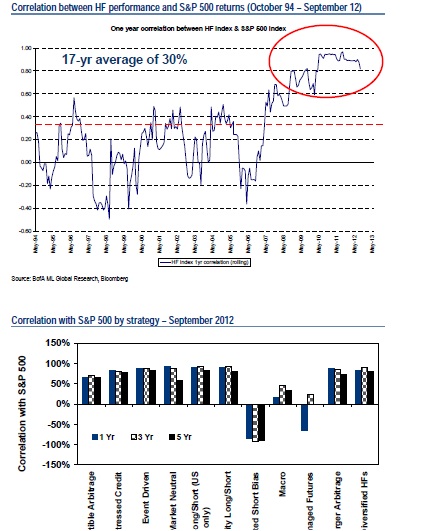

So it’s disconcerting when you see a chart like this which shows how hedge fund correlations are gravitating towards the S&P 500 (via Value Walk):

The worry here is that hedge funds are becoming a lot more like mutual funds which just mimic a highly correlated index and add no real value. Except these funds are charging you 2 & 20 for it. As the HF industry gets larger you have to be much more selective about the funds you input into your portfolio. And if the trend continues it’s possible that we will have to exclude them completely (primarily because the few good ones will be impossible to get into).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.