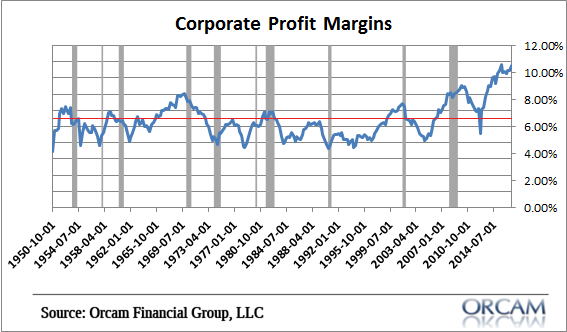

There are few signs of impending doom that are more widely cited than record high profit margins and the inevitable mean reversion that always comes following such an environment. It’s true. As you can see in the chart below profit margins have averaged about 6.5% over the last 65 years and every time they’ve gotten well above that 6.5% range they’ve come back to earth.

(Chart via Orcam Financial Group)

Now, I think there’s some validity to the idea that margins are structurally high (see here for details). In other words, 6.5% isn’t necessarily a magnet sucking profit margins during contractions. But I think it’s safe to say that 10.5% certainly isn’t the new normal either.

But this isn’t a question of if. It’s a question of when. Profit margins will mean revert at some point. But they could also stay high for many years and you could miss huge gains like 2013 waiting for the mean reversion to actually occur.

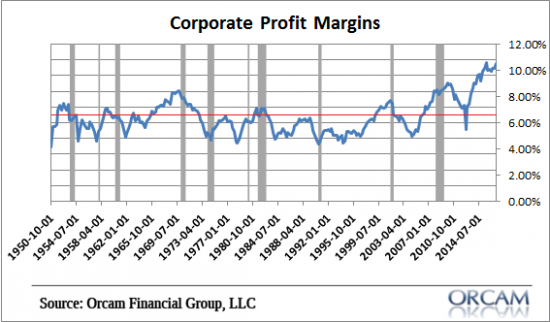

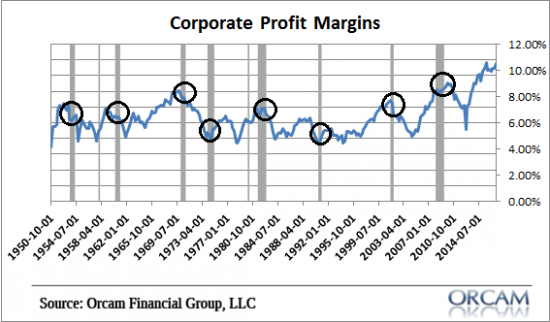

One thing we know is that recessions are devastating for corporations. And they’re not only devastating for corporations, they’re often devastating for markets. In the last 60 years all of the year over year 30%+ declines in the S&P 500 have occurred inside of a recession. In other words, outlier tail risk type returns tend to occur inside of a recession. And if we look at profit margins we find something similar. They almost always contract inside of a recession or within a few months of a recession.

(Chart via Orcam Financial Group)

So again, it comes down to being able to forecast a recession. I hope your model works.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.