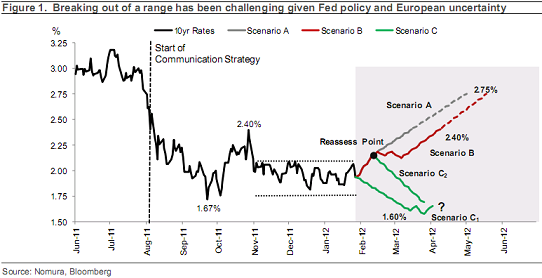

One of the hotter debates going on right now surrounds interest rates and whether the great bull market in bonds will continue. My base case has become bearish on Treasuries after having been bullish last year before the big surge in bonds. In a recent research piece Nomura offered three scenarios for interest rates. I agree with their scenario B in which they view increasing odds of QE3 in Q2 and a rise in yields as the standard portfolio rebalancing plays out as a result of more easing:

“in Figure 1 we show scenarios (with a base case) of the next potential moves where we do not envision the range lasting for much longer.

- Scenario A (20% probability): US data continues to be strong, with a weak 10yr auction as investors try to ascertain a higher coupon at the refunding, and then Japan begins to sell into year-end (March), along with a potential agreement around Greece quickly reverses this week’s Fed-induced rally, pushing rates higher into summer.

- Scenario B (60% probability; our base case): Either US data begins to wane because of seasonality, or European fears resurface, which leads the Fed or ECB to QE in Q2. However, even if data continues to be strong, the initial rise in rates would be met with buying from “value investors”, leading to a temporary range before more easing comes, favoring risk assets.

- Scenario C (20% probability): European fears flare-up and data fades even faster, leading to risk assets (stocks etc) rolling over, helping USTs. The question here is does this happen now or after we hit 2.16%? Either way, whether there is a rebound or new long range will be determined through how bold central bank actions are. Rates would rally first before anticipating a positive catalyst from the Fed‟s and/or ECB‟s next easing move, therefore breaking us to a new lower range.”

Source: Nomura

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.