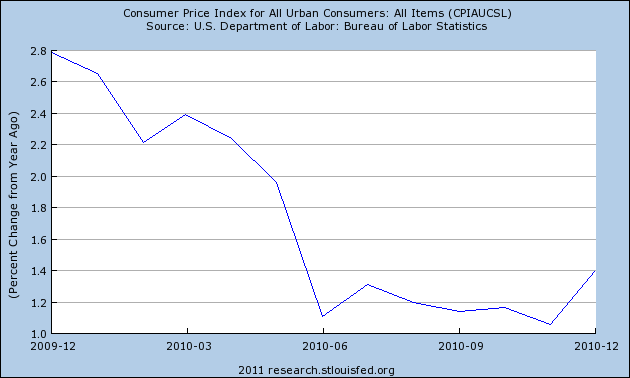

A little over a year ago I said inflation concerns in the USA were blown out of proportion and that we were likely to see an environment of disinflation “with a greater risk of deflation than hyperinflation”. One year later that’s clearly what has occurred in the USA as disinflation ensued. Overall inflation has continued to decline and deflationary fears became so substantial in Q3 2010 that the Fed panicked into implementing QE2. In retrospect, it looks like the Fed jumped the gun as September economic data proved that the summer slowdown and double dip fears were overblown (not that it matters as we remain mired in one continuous balance sheet recession). The good news is we’re not repeating the mistakes of Japan (yet), but we’re also not growing fast enough to meaningfully close the output gap.

But where are we now? Is deflation still the greater risk? What about commodity prices and global inflation? How is this all going to play into the USA’s future inflation/deflation problems?

One thing we know from the credit crisis is that the Fed’s various “money printing” operations have had a far lesser impact on the rate of inflation than most presumed they would. Despite an explosion in the monetary base inflation is near its lows. As I’ve previously discussed, this unusual recession (a balance sheet recession) exposed many flaws in the way we understand the functions of modern banking. The primary myth that has been exposed in recent months is the money multiplier.

Because we’re working in an unusual environment we have to throw out the old playbooks when estimating future rates of inflation. The Fed’s actions are and will continue to be relatively futile in influencing future inflation. Fiscal policy remains intact, however, is likely to come under increasing pressure in the coming years. All of this occurs during a process of de-leveraging by the private sector.

From a demand-pull perspective the story remains little changed from last year. This environment of low capacity utilization and tepid aggregate demand is likely to result in benign inflation. This is due to the continuing strains at the consumer level. A lack of job growth, de-leveraging, falling house prices, etc are likely to continue exerting pressures on the U.S. consumer in the coming years and make demand-pull inflation unlikely.

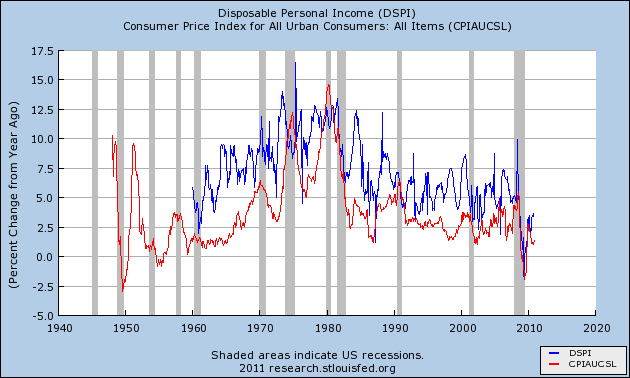

Although commodities have become the hot button topic in recent months, the truth is that labor is still the most significant input in the cost-push inflation equation. And that input remains weak. The strength in corporate America combined with the extreme government response has been just enough to generate some economic growth. But it hasn’t been enough to substantially close the output gap. Love the stimulus or hate it, in this process of de-leveraging, we’re still not running a large enough stimulus package to generate significant wage inflation. Companies are in no rush to hire or increase wages due to a multitude of factors. With high productivity, high corporate margins, record profits, continuing economic uncertainty and rising commodity costs we’re unlikely to see a surge in incomes or hiring in 2012 though I do believe we will continue to see a modest recovery in the labor market.

From this perspective, it’s likely that higher commodity prices will continue to result in higher prices abroad (particularly those commodity based economies), but a deflationary bias in the United States as wages are unlikely to match the increases. This will make it extremely difficult for producers to pass on costs and will ultimately squeeze the consumer. The last time incomes were substantially outstripped by inflation was during the 70’s when surging oil prices created stagflation. That outcome should not be discounted here, however, it’s highly unlikely that inflation would approach anything remotely close to the levels seen in the 70’s given the uniqueness of the current economic environment.

This all adds up to an environment in which we’re likely to continue seeing below average levels (3.5%) of inflation in the USA. Although I do expect inflation to approach ~2.5%+ by the end of 2011 we remain in an environment where downside risks remain more prevalent than the risk of high levels of inflation. An underlying environment of deflation is likely to continue being masked by government intervention and a global recovery that results in higher commodity prices. The risk of hyperinflation remains extraordinarily low based on this outlook and we’re likely to continue experiencing below average levels of inflation although the tepid recovery in the USA and abroad should contribute positively to inflation in the coming year.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.