I’ve had a fair amount of luck fending off fears of high inflation in recent years (see here) and getting the inflation trend right (at least directionally during the last few years of the deflation, inflation, disinflation, inflation sea-saw). Understanding the balance sheet recession and its impacts on the monetary system have been key to this outlook. If you understood the deleveraging story and the fact that banks don’t lend reserves then you knew that the QE’s were not going to be inflationary. You further understood that the massive deficit was merely masking the underlying turmoil occurring at the consumer level.

Late last year I put together a timeline for QE3 (see here) and why I believe there is a high probability of QE3 coming this summer at the June FOMC meeting. My thinking is simple – the Fed doesn’t want to introduce new “stimulative” policy while the rate of inflation remains above their 2% target so we’re unlikely to see further policy action until inflation resides a bit. I think there’s the potential for this to happen in H1 this year.

To understand my thinking we need to start with the various types of inflation – demand-pull inflation and cost-push inflation. As of now, demand-pull inflation appears like a low probability event. Although recent data has shown economic improvement there are still high levels of spare capacity, relatively low capacity utilization rates and generally tepid demand for goods (aggregate demand is still very weak). The large budget deficit is contributing to the demand pull story by helping consumers to continue spending while also deleveraging, but the two combine to equal a modest positive for the economy as a whole.

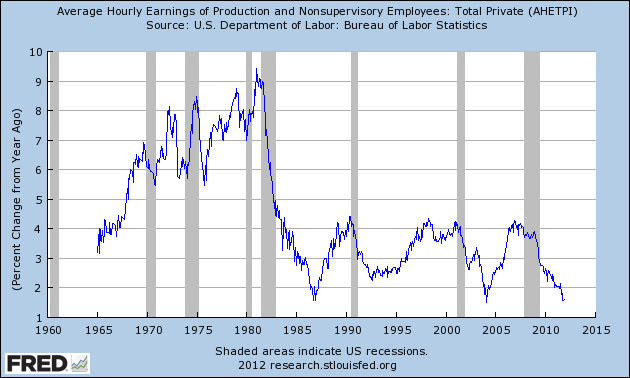

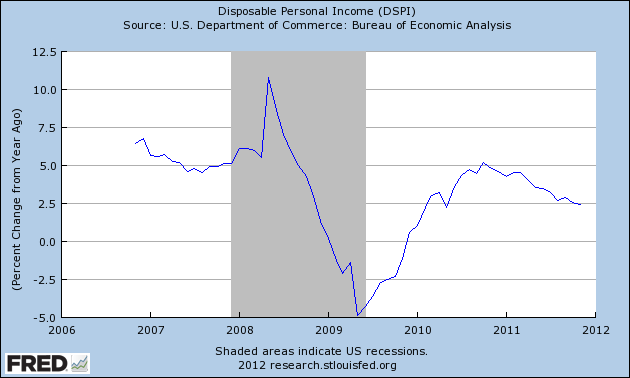

The cost push inflation debate can be answered in one story – jobs. The majority of cost-push inflation is generally due to labor (although oil prices are a growing risk as discussed below). As of now, labor remains weak and the unemployment rate is only slowly declining. The SF Fed sees unemployment remaining above 8% this year. The consumer earnings story is pretty uniform across the economy. Hourly earnings are nearing their lows and real disposable income continues to decline so core inflation is likely to remain depressed:

If you’re looking for a big rebound in these data sets (and much higher inflation) you should probably own a leveraged portfolio of stocks because that would likely be accompanied by a sizable economic boom. While the labor market is picking up steam the signs are tepid at best given the maturity of this recovery.

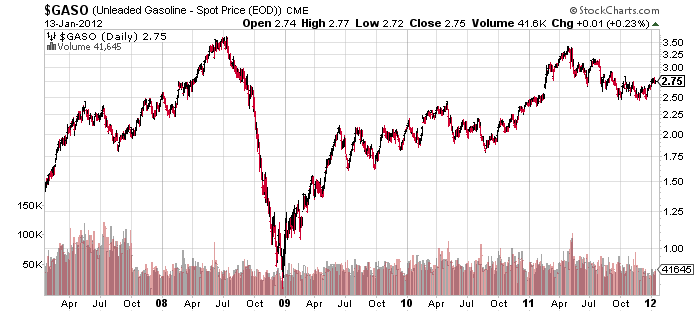

The most important component in headline inflation in recent years has been motor fuel. I’ve highlighted this on several occasions noting the discrepancy in headline and core inflation. You can see the close correlation between headline and motor fuel prices:

The story here is an interesting one. Last year’s oil scare from the Middle East uprisings caused a huge spike in fuel prices. Gasoline prices peaked near $3.40 before falling to $2.50 later in the year. The latest price of $2.75 means prices would have to rally 24% in the next 3 months just to create a 0% YoY climb in fuel prices in April. I’m not saying that’s impossible and I’ve previously stated my bullish stance on oil in general (as a hedge against exactly this), but for the inflation story the picture is clear. The YoY rate of fuel prices is going to decline between now and April unless turmoil causes a huge rally. That means headline inflation is highly likely to experience a brief bout of disinflation between now and the May data set.

I think that could set the table for increasing QE3 talk at the June meeting as the economy is likely to remain weak and fears of a slowing global economy and tepid labor market provoke Fed action.

In sum – prepare for a brief bout of disinflation likely taking the headline rate below 3% before stabilizing just when the Fed thinks it needs to intervene. The major risk to this outlook is further turmoil in the Middle East in which case fuel prices could rally enormously leaving my theory dead in the water.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.