Here’s an interesting note via Lance Roberts at StreetTalk. He notes a recent study from Emory and Duke regarding the tendency for many firms to manipulate their earnings reports:

“There is also another factor that goes into how companies are beating bottom line estimates – legalized manipulation. Two business professors, Ilia Dichev and Shiva Rajgopal at Emory and Duke, conducted a survey of 169 chief financial officers at publicly-traded companies in the U.S. revealed at least 20 percent of the publicly-traded companies that, as required by law, report earnings results on a quarterly basis are probably fudging the numbers. Furthermore, almost every single CFO surveyed agreed that this is the case.

Their study found that “CFOs estimate that in any given period, roughly 20% of firms misrepresent their economic performance by managing earnings.” Further more “For such firms, the typical misrepresentation is about 10% of reported EPS.”

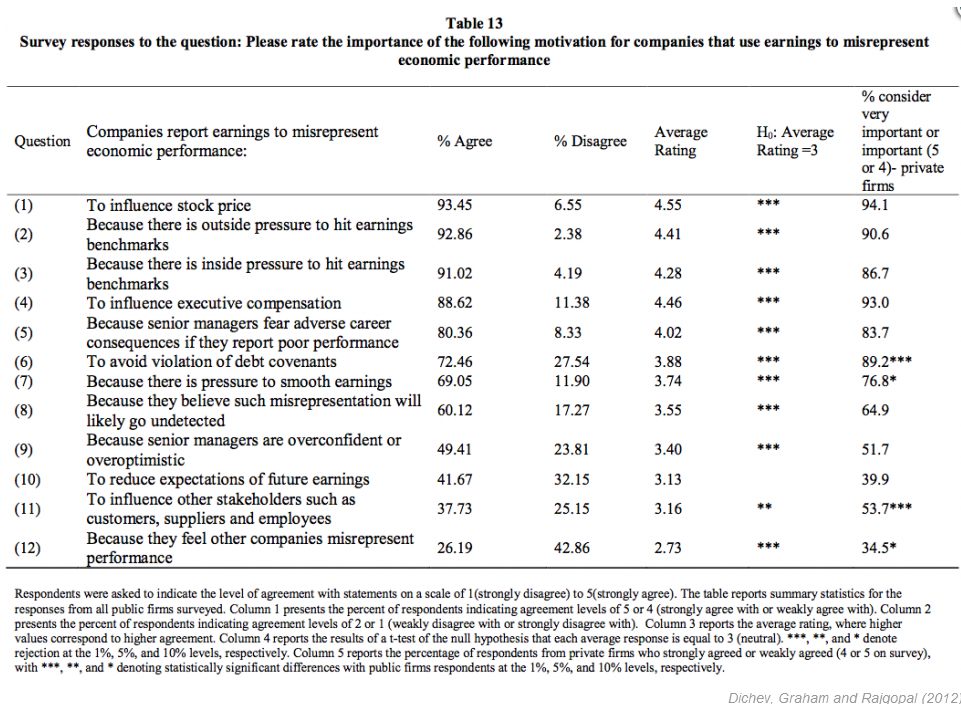

The reasoning behind the fudging of earnings reflects the growing problems of stock based compensation practices. “A large majority of CFOs feel that earnings misrepresentation occurs most often in an attempt to influence stock price, because of outside and inside pressure to hit earnings benchmarks, and to avoid adverse compensation and career consequences for senior executives.“

The table below, from the study, is why companies misrepresent earnings:”

Well, that’s reassuring. At least you know they’re manipulating your stock prices in the right direction….[Sarcasm off].

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.