One of the more enlightening things you learn from a sound understanding of macro is the Kalecki profits equation which shows that corporate profits are the result of the following equation:

Profits = Investment – Household Savings – Government Savings – Foreign Savings + Dividends

What stands out to most people in this is government savings, ie, the government’s budget deficit. It’s strange to think of the government as a source of profits because some people don’t generally like to think that the government is a large source of private sector profits. But that really shouldn’t surprise anyone. After all, when the government pays contractors in Virginia to build planes then those payments get listed as corporate revenues which contribute to the bottom line of corporations. And when you net out investment, household savings, foreign savings and dividends you get the total of corporate profits.

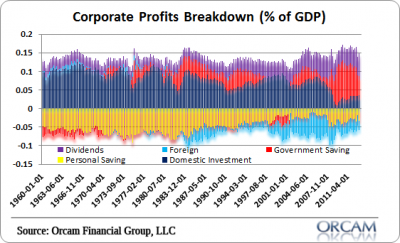

Now, the government played an exceedingly important role in recent years as the deficit has ballooned in the face of the crisis. You might recognize this chart that shows the various components of profit sources as a % of GDP:

Normally, domestic investment drives corporate profits. But when the crisis hit domestic investment (the dark blue bars) tanked as the decline in aggregate demand hurt businesses. The government filled the void to a large degree. But the environment today is pretty different than it was in the heart of the crisis and corporations have started to carry much of the burden again. So let’s update what’s going on.

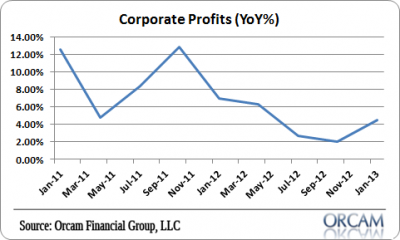

Last year when the sequester talks were in full swing there was concern that the decline in the deficit could cause big profits pressures. I said the most likely scenario was for a slow-down, but something more closely relating to the muddle through that we’re seeing at the macroeconomic level. My profit model was showing low single digit profit growth in 2013 which has been pretty close so far.

Profits have definitely declined to a slower pace (5% YoY in 2013 vs 7.25% in 2013), but it hasn’t been catastrophic even though we’ve seen a pretty substantial decline in the government’s deficit. Why not? Well there are a lot of moving parts in the profits equation. And you can’t really apply the old “ceteris paribus” effect that economists love to apply to certain environments because the economy is non-linear and dynamic. When one piece of the puzzle changes it’s likely the result of other pieces changing at the same time.

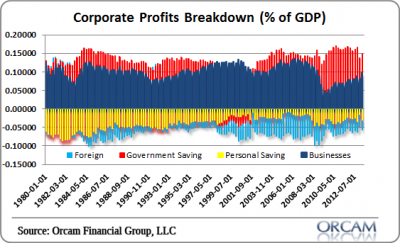

If we look at the components of profits the overall changes (or no changes) since 2012 have been:

- a substantial decline in overall government deficits (-31% YoY)

- modestly expanding private investment (+7.2% YoY)

- a substantial decline in private saving (-15% YoY)

- some deterioration in foreign saving (-5.8% YoY)

- a big rise in dividend payments (+40%)

In other words, the two main drivers that have offset the decline in the budget deficit have been dividend payments and household saving declines while investment growth has remained pretty steady in the high single digits.

What’s interesting is if you consolidate dividend payments into net investment you can see how the corporate sector is now driving the boat. In other words, as the Balance Sheet Recession has ended and households have recovered, it is the business sector that has increasingly picked up the baton to keep the economy going. This was why, as I mentioned several years ago, we were not nearly as bad off as Japan in the 90’s where the business sector was suffering from excessive debt. In the USA it was just the household sector and the government was able to ease the strain there by driving the red bar up. This helped household’s deleverage and kept business from driving the unemployment rate twice as high as it got.

Now the story is changing. As the household sector heals and picks up the burden it’s the business sector that is running with the baton primarily. And as the government’s deficit declines (mainly due to higher tax revenues) this is all a sign that the private sector is healing from a very rare debt disease.

My guess is that households are saving less because their net worths are rising again on the back of housing prices and the stock market. And dividend payments have increased because corporate America is a lot healthier than it has been in a long time.

Overall, profits are up 4.5% as of the latest reading which is down from the high single digit readings we saw for much of last year. That’s down, but not a disaster. So the sum of the parts has been a more modest effect on overall profits than we might have expected if all the other pieces had remained the same and the deficit had declined 30%. In other words, if private saving, dividends and investment hadn’t continued to move higher in the last 18 months we would have seen a substantial decline in profits. Instead, the decline in the budget deficit has been largely swallowed up by the other components.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.