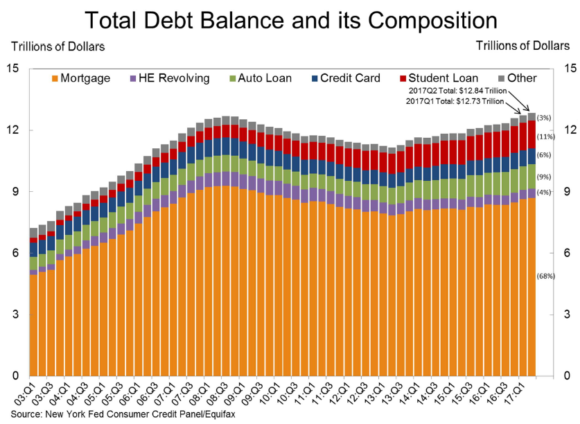

The NY Fed released a new update on household debt today showing record levels. Now, at first glance you might be inclined to say “holy cow Batman, we’re on the brink of another 2008 repeat!”

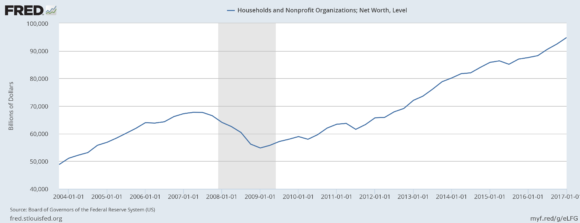

Well, not so fast though. When we look at a balance sheet we have to first look at both sides of that balance sheet. While the liabilities have surged so too have the assets. Household net worth is at a record high.

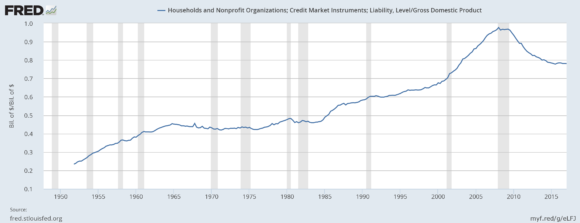

Of course, household net worth was also at a record high in 2008 before things fell apart. So you might say, “holy cow Batman, we’re on the brink of another 2008 repeat!” Well, not so fast though. Household debt as a % of GDP has fallen dramatically in the last few years:

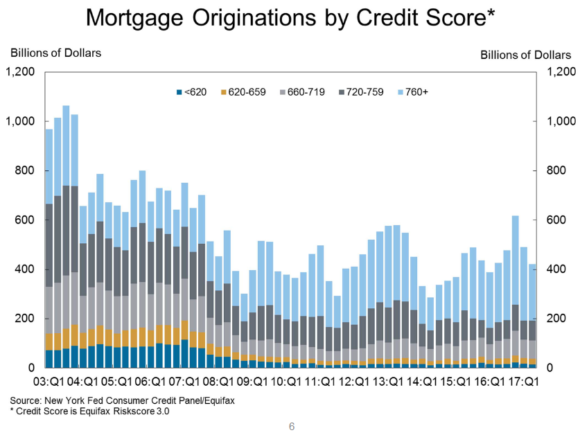

This is important because it means that more income is servicing about the same amount of debt. But the story gets better from here. When we look at the quality of the new debt we actually see an improvement there as well. For instance, look at the quality of new mortgage originations:

This is important because a big part of what was happening in 2008 was that the new debt being issued was being issued to people with low credit quality. So you had a low quality income stream servicing a high quantity of debt. Today is different. There is more income servicing the same amount of household debt as the 2008 peak. And the overall quality of the debt has improved. So you have a higher quality income stream servicing the same amount of debt. This means that the new peak in household debt is far less worrisome than the levels we saw in 2008 and more likely part of a much needed boost in overall debt servicing more productive economic purposes.¹

NB – Some people will say “Batman, you are overlooking student loans and auto loans!”² No Robin, I am not.³ It’s just that those are small relative pieces of the puzzle (11% for student loans and 9% for autos vs 68% for mortgages) here and if you make comparisons like this, as some famous pundits have, then you need to put things in the right perspective.

¹ – If you’re looking for a bigger risk credit story in the economy I would recommend looking into corporate credit. I bet you can come up with some seriously scary stories there.

² – Yes, I did just imply that I am Batman in this conversation. No, not the Ben Affleck Batman. I mean the Michael Keaton Batman. Duh.

³ – Yes, I did just imply that you are Robin in this conversation. I will let you pick your favorite Robin. You’re welcome.

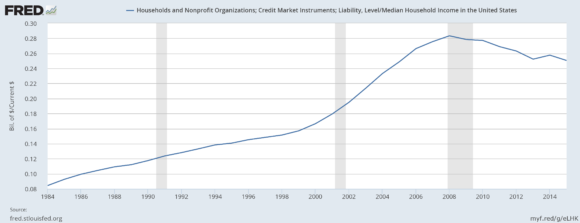

Update – I thought I covered all of my bases here, but then I started getting emails and responses about median income relative to household debt. But I did actually think about that. Household debt relative to median household income is down so there’s that.

Update 2 – After thinking long a hard about this I would like to switch my choice of Batman to Adam West. In addition to being a great guy I think he was a real super hero for having the courage to wear those tight tights.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.