That’s the question Matt Taibbi asks at Rolling Stone. Yves Smith calls the LIBOR scandal a “huge deal”. And Robert Reich says this is the “scandal of all scandals”. I’ve gotten very angry at some of the actions of the financial sector over the last 10 years, but I am having troubling finding a good reason to “freak out” over this. I know it’s popular these days to get mad at banks every time they do something even remotely wrong, but I have a feeling the media is making a mountain out of a molehill here. My reasoning is rather simple.

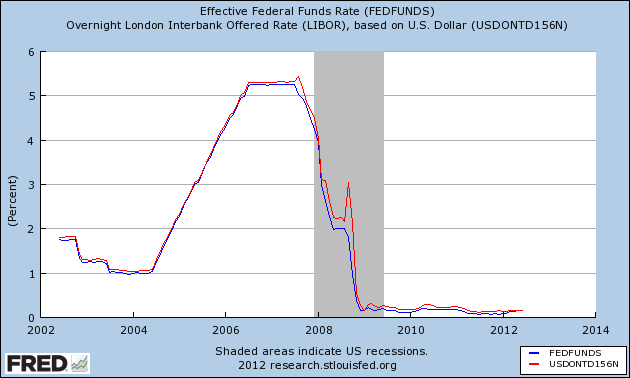

1) If you compare the Fed Funds Rate and the overnight LIBOR rate you’ll find a 99.6% correlation between the monthly prices over the last 10 year period. In other words, if these banks were colluding to manipulate rates then the world’s most important central bank was the key rate they were basing this grand “manipulation” off of – and the banks were doing a damn good job relaying the accurate overnight rate. Of course, central banks are in the game of manipulating rates. That’s their primary policy tool. So it’s not surprising that the world’s largest banks were basically keying their rates off the Fed Funds Rate. Either way, for a banking oligopoly these banks were doing a pretty good job submitting prices that were pretty much 100% in-line with the Fed Funds Rate. If they were “manipulating” the rate themselves then they suck at manipulating prices.

2) If Barclays was submitting prices that were substantially outside of the average price submissions then their prices would have been thrown out most of the time. LIBOR is set by collecting the submitted prices and throwing out the top and bottom quartile. It’s hard to “manipulate” the rate much when your price submission isn’t even impacting the actual rate. Again, this appears entirely consistent with the data findings above. Either Barclay’s was submitting what they claim were “realistic” prices or the other banks were averaging out to equal the Fed Funds Rate. Which is just about exactly what the data shows and what one would expect to happen.

3) There’s also a certain political hypocrisy in all of this. On one side of the aisle you have Conservatives perpetually complaining about “manipulation” in overnight rates due to the Central Bank and on the Left you now have people complaining about “manipulation” over the LIBOR rate set by private banks. One side generally hates financial capitalism and the other side generally hates capitalism manipulated by government intervention of any kind. Maybe it’s time to just accept the fact that central banks manipulate rates and banks key their rates off this rate? And according to the 10 years of LIBOR data they’re actually pretty damn good at it.

4) Banks are not good with internal controls, disclosures and risk management. Some of the reports on this scandal make that clear. But what else is new? Did we all just sleep walk through the last decade? Granted, the disclosures and regulations needed to be tightened up here and the LIBOR scandal is more evidence of this, but it’s nothing we didn’t already know.

This all makes for tantalizing reading and it’s compounded when people throw out huge figures like “$800 TRILLION”, but the reality is that this scandal doesn’t tell us anything we didn’t already know. Unless you’re digging for political footing or page views, the short answer to the LIBOR scandal is – no one is freaking out because there’s nothing new here that we didn’t already know.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.