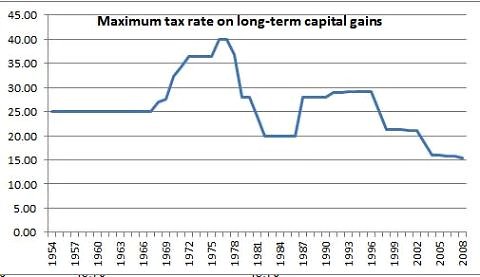

Mitt Romney, a multi-millionaire, pays a 15% tax rate. Warren Buffett, a multi-billionaire pays a lower tax rate than his secretary. It’s primarily due to the fact that they make huge gains in investments every year and pay the very low cap gains rate. Does this make sense? As Paul Krugman noted the other day, cap gains are at an all-time low (see chart below). This trend in declining cap gains started in 1997 and clearly hasn’t correlated with a booming economy. So the traditional argument that high cap gains hurt the economy doesn’t seem to hold. In fact, the most illuminating comments come from Warren Buffett on Charlie Rose who cites the fact that an investor rarely considers potential tax rates when making an investment (a general observation obviously):

BUFFETT: I have yet– and I’ve worked with capital gains rates of 39.9 percent and 36 percent and 25 percent, I have yet to hear one person say to me, “If I call you in the middle of the night Charlie and I say Charlie I’ve got this hot investment idea.” Your reaction is not to say “No matter what the tax rate, forget it, I’m going back to sleep because the capital gains rates are too high.” No, what you’re going to do is you’re going to say, “Tell me the name, quick, Warren, before you change your mind.” And you know, I have never had one person decline to invest with me.

ROSE: Yes.

BUFFETT: And I was running money 40, 50 years ago when rates were much higher and I never had one person to show the slightest reluctance to take an investment idea and run with it.

The point Buffett is making is that people don’t rule out broad investment decisions because of capital gains. They might play a role, but how many times have you flat out decided not to buy a stock, bond or invest in something else solely because of the tax implications? My guess is not very often. Making money in the investment world is the goal. The government gets a cut. Those are just facts of life. If you build portfolios entirely around taxes then you’re likely neglecting the more important part of portfolio building – the actual money making strategy! This doesn’t mean taxes don’t matter, but I don’t think a cap gains rate of 25% is going to suddenly cause Americans to stop investing in corporate America….

Don’t get me wrong. I love low cap gains rates because I’ve benefited from this as well (clearly not to the extent that some others have!), but unless I am missing something, this seems like another neoliberal myth that is helping no one except people who don’t really need the help….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.