Greece is back in the news. There’s a devastating recession in oil. Emerging market turmoil is widespread. The Fed is worried about global growth so much that they won’t raise rates. Earnings are declining. According to our Presidential candidates the economy stinks and America needs a restart. And…the S&P 500 is approaching a new all-time high? What. The. Hell. Is. Going. On?

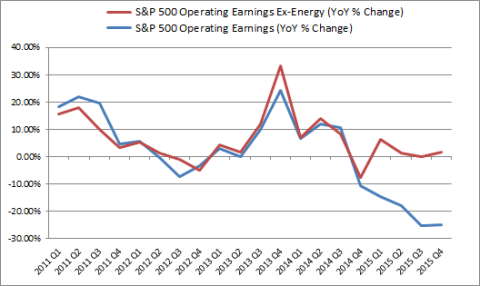

My view in the last couple of years has been simple. What we’re seeing is a highly divergent economic environment. That is, we’ve had a devastating decline in energy prices resulting largely from the slowdown in emerging markets. So, we’ve had punishing bear markets in emerging market stocks and energy stocks. But outside of these segments of the global economy things look, just, okay. To visualize this we can look at S&P 500 operating earnings by sector contribution:

Now, I know it’s not popular to ex-anything from data (inflation, prices, etc), but this gives some good insight into what’s going on at present. Basically, the rest of the S&P 500 is doing okay. And by okay, I mean, flattish. This also explains the sideways market action in recent years. And this has been confirmed by most of the macro data we’ve seen in recent years. It hasn’t been great, but it hasn’t been the nightmare that some people have made this out to be. Unfortunately, anyone who abandoned a well diversified portfolio in the last 18 months is probably kicking themselves now as the 2008 repeat that so many predicted isn’t playing out. Following a simple macro model would have helped a lot of people avoid getting scared out of the market by what is looking like a concentrated recession in some parts of the global economy.

Of course, I hesitate to write about such short-term matters. I’m hardly some raging bull at this stage in the market cycle as I view stocks as being late stage and probably higher risk, lower return vehicles than normal, but this doesn’t mean we should be overly bearish about the stock market. Extremist views are almost always wrong. And that’s a big part of why I am such an advocate of macro investing – focusing on the forest helps us ignore many of the fires occurring in parts of that forest. Those fires can be scary, but there will always be fires somewhere. The key is putting things in the proper context so you aren’t constantly getting scared out of a good plan.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.